12 min read

From Denials to Dollars: Mastering Revenue Cycle Management Analytics

Jeremy Wayne Howell

:

Dec 25, 2025 3:40:48 PM

The Unseen Friction in Your Financial Engine

Revenue cycle management analytics is the systematic use of data to analyze, track, and optimize the entire healthcare revenue cycle—from patient registration to final payment. It moves beyond traditional reporting to provide predictive insights that reduce denials, accelerate cash flow, and recover lost revenue.

Key benefits of RCM analytics include:

- Reduced claim denials by up to 40% through predictive flagging and root cause analysis

- Faster cash flow with 15-20% reduction in accounts receivable days

- Recovered revenue by identifying underpayments and billing errors before they become write-offs

- Proactive decision-making through real-time visibility into financial performance

- Improved patient satisfaction via streamlined billing and payment processes

Right now, 25% of nonprofit hospitals are operating with negative margins. More than half of all hospitals weren't profitable in 2022.

The pressure is real.

You're working harder. Your team is working harder. But the financial results don't reflect that effort.

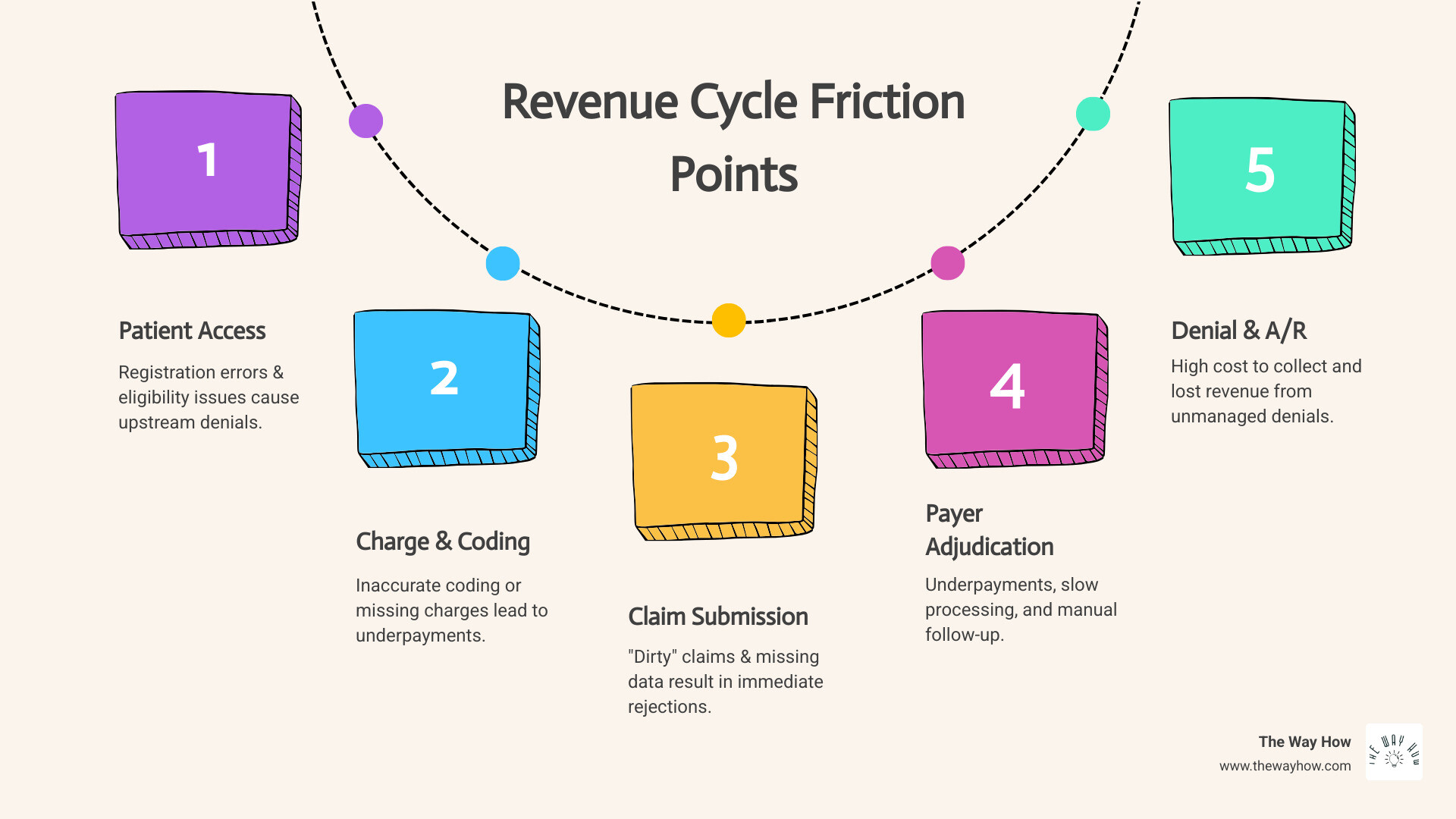

The problem isn't effort. It's friction.

Your revenue cycle is full of it. Claims denied for preventable reasons. Payments delayed by 60, 90, 120 days. Underpayments that go unnoticed. Patient balances that never get collected. Each friction point bleeds revenue—often 3-5% of your potential income just disappears.

Most healthcare organizations are data-rich but insight-poor. They have reports. Lots of reports. But reports tell you what happened. They don't tell you why it happened, what will happen next, or what to do about it.

That's the difference between traditional Revenue Cycle Management (RCM) and revenue cycle management analytics.

Traditional RCM is reactive. It's fire-fighting denials after they happen. Chasing payments that are already late. Finding problems only when they show up in your monthly financials.

Analytics is different. It's about seeing the friction before it costs you money. Predicting which claims will be denied. Identifying which payers consistently underpay. Knowing exactly where your process breaks down—and fixing it.

This isn't about getting more dashboards. It's about asking better questions. And getting answers that actually change outcomes.

The Mindset Shift: From Reporting What Happened to Predicting What Will

For too long, healthcare revenue cycle management has been a game of catch-up. We've relied on monthly or quarterly reports that summarize past performance, leaving us to react to problems long after they've impacted our bottom line. This approach, while providing some visibility, often leaves us feeling overwhelmed and uncertain about how to truly improve.

Our focus at The Way How is to help organizations shift from this reactive stance to a proactive, predictive one. It's not about simply generating more reports; it's about asking better questions, understanding the underlying human behaviors and systemic issues, and leveraging data to anticipate and prevent problems before they occur. This fundamental mindset shift is where the true power of revenue cycle management analytics lies.

What is Revenue Cycle Analytics?

At its core, revenue cycle management analytics is a sophisticated, data-driven approach designed to optimize and streamline every financial process within a healthcare organization. It involves systematically collecting, integrating, analyzing, and interpreting vast amounts of financial and operational data that flow through the entire revenue cycle – from the moment a patient schedules an appointment to the final collection of payment.

Unlike traditional RCM, which often relies on manual processes and reactive problem-solving, analytics provides proactive insights. It helps us move beyond simply reporting on "what happened" to understanding "why it happened" and, crucially, "what will happen next." This is achieved through predictive modeling, real-time monitoring, and automated reporting, all designed to illuminate inefficiencies, identify opportunities, and guide strategic decision-making.

The healthcare industry recognizes this critical need. A survey by the Healthcare Financial Management Association (HFMA) found that while a significant 90% of healthcare financial executives acknowledge the importance of analytics, only about 40% report having mature analytics capabilities. This gap represents a vast opportunity for organizations to gain a competitive edge and secure their financial future.

The Four Levels of Analytical Maturity

To truly master revenue cycle management analytics, it's helpful to understand the different levels of analytical maturity. Each level builds upon the last, offering increasingly sophisticated insights:

- Descriptive Analytics (What happened?): This is the most basic level, summarizing historical data to show past events. Traditional RCM reports often fall into this category, telling us, for example, our denial rate last month or our average A/R days. While essential for a baseline understanding, it's merely a rearview mirror.

- Diagnostic Analytics (Why it happened?): Moving beyond simple reporting, diagnostic analytics digs into the root causes of past events. If our denial rate increased, diagnostic analytics helps us investigate why – was it due to specific payer issues, coding errors, or front-end registration mistakes? This involves drilling down into data to uncover patterns and correlations.

- Predictive Analytics (What will happen?): This is where analytics truly becomes proactive. By leveraging historical data, statistical models, and machine learning, predictive analytics forecasts future outcomes. For instance, it can predict which claims are likely to be denied, which patients might struggle with payments, or how a change in payer policy might impact revenue.

- Prescriptive Analytics (What should we do?): The highest level of analytical maturity, prescriptive analytics not only predicts what will happen but also recommends specific actions to optimize outcomes. It suggests the best course of action to prevent denials, accelerate collections, or improve patient satisfaction, providing actionable steps rather than just insights.

By progressing through these levels, organizations can transform their RCM from a reactive operation into a strategic function that anticipates challenges and guides decisions.

The Role of AI and Machine Learning in Revenue Cycle Management Analytics

The future of revenue cycle management analytics is inextricably linked with artificial intelligence (AI) and machine learning (ML). These advanced technologies are not just buzzwords; they are becoming indispensable tools for changing how we manage our revenue cycles.

AI and ML significantly improve RCM analytics by enabling:

- Predictive Denial Management: Instead of waiting for denials to occur, AI models can analyze vast amounts of historical claims data, identify patterns, and flag high-risk claims before submission. This allows our teams to intervene proactively, correct potential errors, and prevent denials, saving significant time and resources.

- Automated Decision-Making: AI can automate routine decisions and tasks, such as routing denied claims to the appropriate specialist for appeal based on denial codes and historical success rates. This streamlines workflows and frees up staff to focus on more complex issues.

- Natural Language Processing (NLP): NLP allows systems to understand and process unstructured data, such as payer notes, clinical documentation, or patient correspondence. For instance, NLP can extract key justifications from clinical notes to support appeals or identify common reasons for denials buried in free-text fields.

- Identifying Hidden Patterns: ML algorithms can uncover subtle correlations and patterns in data that human analysts might miss. This can lead to unexpected insights into payer behavior, patient payment trends, or operational inefficiencies.

The impact of these technologies is profound. According to McKinsey & Company, healthcare providers that accept digital solutions and analytics can achieve productivity improvements of 15% to 20%. This is not just about efficiency; it's about building a more resilient and financially stable healthcare system.

Diagnosing the Leaks: Key Metrics That Reveal Your Revenue Cycle's Health

We often talk about "revenue leakage," but what does that truly mean for your organization? It means money earned but not collected, services rendered but not reimbursed, and countless hours spent chasing payments that should have been straightforward. To stop this leakage, we must first understand where and why it's happening. This is where Key Performance Indicators (KPIs) become our vital signs.

KPIs are not just numbers to track; they are critical diagnostic tools that reveal the health of your revenue cycle. Understanding them is the first step in pinpointing where revenue is being lost and, more importantly, how to recover it.

Front-End & Claim Integrity KPIs

These KPIs focus on the accuracy and efficiency of your processes before and during claim submission, directly impacting how quickly and successfully you get paid.

- Clean Claim Rate (CCR): This metric measures the percentage of claims that are submitted without errors and processed successfully on the first attempt. A high CCR indicates strong front-end processes, accurate patient data, and precise coding. Our goal should be 95% or higher, as any claim that isn't "clean" requires costly manual intervention.

- First-Pass Yield (FPY): FPY is the percentage of claims paid correctly upon initial submission, without requiring any rework or resubmission. It represents the most efficient path to optimized revenue. According to data from Inovalon, top-performing organizations achieve first-pass yields of 93% or higher. This signifies that the claim went through flawlessly the first time.

- Denial Rate: This is the percentage of claims that are rejected or denied by payers. A high denial rate is a red flag, indicating significant revenue leakage and operational inefficiencies. While top-performing healthcare organizations maintain denial rates below 5%, the industry average hovers between 6% and 10%. Each denial costs time and money to resolve, and some are never recovered. Around one out of every ten claims is denied, representing a substantial risk to your financial stability.

Back-End & Cash Flow KPIs

Once claims are submitted, these KPIs monitor the efficiency of payment collection and the overall financial health of your accounts receivable.

- Days in Accounts Receivable (A/R): This measures the average number of days it takes to collect payment after a service has been rendered. Lower A/R days mean faster cash flow and improved financial stability. The Healthcare Financial Management Association (HFMA) suggests that best-practice organizations maintain A/R days below 45, with top performers achieving 30-35 days.

- Net Collection Rate: This KPI reflects the percentage of collectible revenue that is actually collected, after accounting for contractual adjustments and write-offs. A net collection rate of more than 95% is generally considered excellent, indicating effective billing and collection processes.

- A/R Over 90 Days: This measures the percentage of your total outstanding accounts receivable that are more than 90 days old. A high percentage here signals potential problems with delayed payments, unresolved denials, or uncollected patient balances. A benchmark suggests that less than 15% of claims should be more than 90 days in A/R.

Using KPIs for Effective Revenue Cycle Management Analytics

Simply tracking these KPIs isn't enough. The true value comes from using revenue cycle management analytics to interpret them, understand their interdependencies, and drive actionable change.

- Benchmarking Performance: We use industry benchmarks (like those from HFMA) to compare your organization's performance against peers and top performers. This helps us identify where you stand and pinpoint specific areas for improvement.

- Identifying Performance Gaps: Analytics allows us to drill down into the data behind the KPIs. If your denial rate is high, we can use diagnostic analytics to identify the specific payers, service lines, or coding issues contributing to it. This moves us from knowing what is wrong to understanding why.

- Setting Quantifiable Goals: With clear insights, we can set specific, measurable, achievable, relevant, and time-bound (SMART) goals for improvement. For instance, aiming to reduce denials from 8% to 5% within six months. Organizations that set clear, quantifiable goals are three times more likely to achieve significant improvements than those with vague objectives.

- Tracking Trends Over Time: Continuous monitoring of KPIs allows us to track progress, identify emerging issues, and adapt strategies in real time. This ensures that improvements are sustained and that your revenue cycle remains optimized.

The Strategic Advantage: How Analytics Drives Predictable Revenue

The shift from reactive RCM to proactive, data-driven revenue cycle management analytics isn't just about cutting losses; it's about building a strategic advantage. It transforms your financial operations from a source of constant uncertainty into a predictable engine for growth. By leveraging insights from your data, we empower your organization to make informed decisions that secure and maximize your revenue streams.

Reduce Revenue Leakage and Prevent Denials

Revenue leakage is a pervasive problem in healthcare, with organizations typically losing 3-5% of potential revenue through various points of friction. A significant portion of this loss stems from claim denials and underpayments. Here's how analytics offers a powerful solution:

- Pinpointing Underpayments: Analytics can carefully compare payments received against contracted rates, identifying discrepancies and systemic underpayments from payers. A JAMA Network Open study highlights the significant financial impact of underpayments, underscoring the need for vigilant monitoring.

- Identifying Denial Root Causes: Instead of merely appealing individual denials, analytics helps us identify the recurring patterns and underlying causes. Is it consistently incorrect patient demographic data? A specific coding issue? A particular payer's policy? By identifying these root causes, we can implement systemic changes that prevent future denials.

- Predictive Flagging of High-Risk Claims: Leveraging AI and machine learning, revenue cycle management analytics can flag claims with a high likelihood of denial before they are even submitted. This allows for proactive intervention and correction, drastically reducing the volume of denials. Inovalon reports that effective analytics implementation can reduce denial rates by up to 40%. This proactive approach shifts the focus from costly denial management to efficient denial prevention.

Accelerate Cash Flow and Reduce A/R Days

Delayed payments and extended A/R days can stifle your organization's financial liquidity, making strategic planning difficult. Analytics provides the tools to accelerate cash flow:

- Uncovering Process Bottlenecks: By analyzing the entire revenue cycle workflow, analytics can pinpoint bottlenecks and inefficiencies that slow down payment cycles. This could be anything from delays in charge capture to slow claims processing or inefficient follow-up.

- Optimizing Collection Strategies: Analytics helps tailor collection strategies by identifying which patient segments are most likely to pay and through which channels. It can also prioritize follow-up efforts on high-value or easily resolvable accounts, ensuring resources are allocated effectively.

- Improving Payment Velocity: With insights into payer payment patterns and internal process efficiencies, organizations can implement changes that directly reduce the time it takes for claims to be paid. Organizations that adopt comprehensive analytics often see a 15-20% reduction in A/R days, directly impacting their financial health.

Strengthen Payer Negotiations and Contract Management

Payer contracts are complex, and ensuring compliance and optimal reimbursement requires robust data. Revenue cycle management analytics provides the data-backed insights needed to level the playing field during negotiations and enforce contract terms.

- Data-Backed Insights into Payer Behavior: Analytics generates detailed payer scorecards, revealing which payers consistently delay payments, deny claims for specific reasons, or underpay for certain services. This intelligence is invaluable for understanding payer performance and identifying trends.

- Analyzing Payment Patterns: By tracking payment patterns over time, organizations can identify shifts in payer behavior or policy that might impact revenue. This foresight allows for proactive adjustments to billing practices or engagement with payers.

- Identifying Contract Non-Compliance: Analytics can automatically audit payments against contracted rates, immediately flagging any instances of underpayment or non-compliance. This empowers your team to challenge discrepancies effectively and recover lost revenue, ensuring you are paid what you are owed under your agreements.

Building a System for Certainty: Implementation and Best Practices

Implementing a robust revenue cycle management analytics program is not just about acquiring new software; it's about building a system for certainty. It requires a commitment to data quality, clear communication, and fostering a culture where data-driven decisions are the norm. We've seen that the most effective solutions are those that seamlessly integrate into existing workflows and empower teams with actionable intelligence.

Ensuring Data Accuracy and Integration

The foundation of effective analytics is accurate and integrated data. Without it, even the most sophisticated tools will yield unreliable insights.

- Data Governance: Establishing strong data governance policies is paramount. This includes defining data ownership, standardizing data definitions, and implementing clear processes for data entry, validation, and maintenance.

- Consolidating Disparate Systems: Healthcare organizations typically manage financial data across multiple systems—practice management systems, electronic health records (EHRs), clearinghouses, and payer portals. Effective analytics requires normalizing and consolidating these diverse data streams into a unified, accurate view. This often involves robust data integration capabilities to break down data silos and create a comprehensive data ecosystem.

- EHRs, Practice Management Systems, Payer Portals: Each of these sources holds critical pieces of the revenue cycle puzzle. Data from EHRs informs coding, practice management systems handle billing and scheduling, and payer portals provide crucial information on claim status and remittances. Integrating these sources is complex but essential for a holistic analytical view. The American Academy of Family Physicians (AAFP) recommends implementing a robust data quality program, emphasizing routine audits, standardized definitions, and clear accountability for data integrity.

The Power of Data Visualization in RCM

Raw data, no matter how accurate, can be overwhelming. This is where data visualization transforms complex insights into easily digestible and actionable information.

- Communicating Complex Insights Simply: Powerful visualization tools present complex data in accessible formats, such as interactive dashboards and graphical reports. This makes it easier for diverse stakeholders—from front-line staff to executive leadership—to understand trends, identify anomalies, and grasp the story the data is telling.

- Interactive Dashboards: Customizable dashboards allow users to drill down into specific details, filter information, and explore different aspects of the revenue cycle. This empowers staff to conduct their own diagnostic analysis and find answers to their specific questions.

- Role-Based Reporting: Different roles within an organization require different types of insights. Data visualization allows for custom reports and dashboards that provide relevant information to specific teams, whether it's a coder needing denial reasons or a CFO monitoring overall financial health.

- Empowering Staff with Actionable Information: When staff can clearly see the impact of their actions on KPIs, they become more engaged and proactive. Data visualization fosters a culture of accountability and continuous improvement, turning raw data into a clear, compelling narrative that drives action.

Overcoming Common Implementation Challenges

While the benefits of revenue cycle management analytics are clear, implementation can come with its own set of challenges. We understand these problems and help organizations steer them with a psychology-first approach.

- Data Silos: As mentioned, data often resides in disparate systems, creating silos that hinder a unified view. Overcoming this requires strategic planning for data integration and robust technical solutions.

- Lack of Skilled Staff: Many organizations lack the in-house expertise to implement, manage, and interpret advanced analytics solutions. This can be addressed through training, strategic hiring, or partnering with specialized firms.

- Resistance to Change: Any new system will inevitably encounter resistance. Our approach focuses on understanding the human element—the anxieties, habits, and mental models that resist change. We build empathy and clarity around the "why" behind the analytics, demonstrating how it simplifies work and leads to better outcomes, rather than just imposing new tools.

- Securing Leadership Buy-in: Without strong leadership support, analytics initiatives can falter. We help articulate the clear ROI and strategic imperative of analytics, ensuring that leadership champions the change.

- Choosing the Right Technology Partner: Selecting an analytics platform and implementation partner that aligns with your organization's specific needs, budget, and long-term goals is crucial for success.

Frequently Asked Questions about Revenue Cycle Management Analytics

How much can we expect to save by implementing RCM analytics?

The financial impact of implementing revenue cycle management analytics can be substantial. Effective analytics implementation can reduce denial rates by up to 40%, significantly impacting your bottom line. For a mid-sized hospital with $500 million in annual revenue, reducing denial rates by this much could represent $10-20 million in recovered revenue. Additionally, organizations adopting comprehensive analytics often see a 15-20% reduction in A/R days, leading to faster cash flow. Most providers typically see a positive return on investment within 12-18 months of implementation, making it a highly valuable investment.

Can small healthcare practices benefit from RCM analytics?

Absolutely. Revenue cycle management analytics provides significant benefits for healthcare organizations of all sizes. While large health systems implement comprehensive platforms, smaller practices can leverage cloud-based solutions that offer many of the same analytical capabilities at a lower cost and with faster implementation. Small practices often see proportionally greater benefits because they typically have greater opportunities for improvement and less sophisticated existing processes. It effectively levels the playing field, allowing smaller practices to optimize their revenue cycle and compete more effectively against larger competitors.

How does RCM analytics differ from the reports in our current billing software?

The key difference lies in depth, integration, and foresight. Traditional reports from your current billing software are primarily descriptive—they tell you what happened (e.g., last month's total charges, number of claims submitted). They are often siloed, providing data only from that specific system.

Revenue cycle management analytics, on the other hand, is diagnostic, predictive, and prescriptive. It integrates data from multiple sources (EHRs, practice management systems, clearinghouses, payer portals) to provide a holistic view. It doesn't just tell you what happened, but why it happened, what will happen next, and what you should do about it. This shift from retrospective reporting to proactive insight is what transforms your revenue cycle from a reactive process into a strategic asset.

Conclusion: From Uncertainty to a Predictable Growth Engine

Mastering revenue cycle management analytics is not about chasing metrics; it's about removing the uncertainty that plagues healthcare finance. It's about building a system that connects your team's daily actions to predictable financial outcomes, creating clarity, trust, and momentum.

At The Way How, we believe that predictable revenue comes from understanding human behavior and designing systems that eliminate friction points. By diagnosing the root causes of financial leakage and operational inefficiencies through advanced analytics, we help organizations build the strategic systems needed to transform their revenue cycle into a dependable growth engine.

We help you move beyond the daily firefighting, empowering your team with the insights and tools to make informed, proactive decisions. This leads to not just financial stability, but also improved patient satisfaction and a renewed sense of purpose within your organization.

Learn more about our services and how we can help you turn denials into dollars.

Want to Learn Something Else?

A Practical Guide to Healthcare Revenue Cycle Analytics