13 min read

The Definitive Guide to Revenue Cycle Analytics

Jeremy Wayne Howell

:

Jan 9, 2026 7:41:24 PM

From Financial Fog to Predictable Performance

What is revenue cycle analytics? Revenue cycle analytics is the use of data to analyze, track, and optimize how organizations generate and collect revenue — from the first customer or patient interaction through final payment. It moves beyond basic reporting to uncover patterns, predict outcomes, and recommend actions that improve cash flow, reduce revenue leakage, and streamline operations.

Quick Answer:

- What it is: A data-driven approach to understanding and improving the entire revenue generation process

- What it does: Identifies bottlenecks, predicts payment delays, reduces claim denials, and accelerates cash collection

- Who needs it: Healthcare providers, service organizations, and any business where revenue timing and accuracy are critical

- Key difference from traditional management: RCA provides proactive intelligence and predictive insights, not just historical reports

If you're reading this, you probably know something isn't working.

Maybe your accounts receivable days keep climbing. Maybe claim denials are eating into your margins. Maybe you're flying blind between "we submitted the claim" and "we got paid" — and that gap is costing you more than you realize.

The truth is, most organizations don't have a revenue problem. They have a clarity problem.

They're managing revenue cycles with manual processes, fragmented data, and reactive problem-solving. They know revenue is leaking somewhere, but they can't pinpoint where. They track metrics, but those metrics don't connect to decisions. They invest in technology, but the technology doesn't tell them what to do next.

Revenue cycle analytics changes that.

According to McKinsey & Company, healthcare providers that accept digital solutions and analytics can achieve productivity improvements of 15 to 20%. Yet a survey by the Healthcare Financial Management Association (HFMA) found that while 90% of healthcare financial executives recognize the importance of analytics, only about 40% report having mature analytics capabilities.

That gap represents both a risk and an opportunity.

The organizations that close it don't just improve their numbers. They build predictable, scalable revenue systems — systems that flag problems before they become write-offs, that prioritize the right actions at the right time, and that turn data into confidence.

I'm Jeremy Wayne Howell, founder of The Way How, and I've spent over two decades helping revenue leaders build clarity into chaos — including implementing systems that use what is revenue cycle analytics to diagnose where revenue stalls and why. This guide will show you how to do the same.

How RCA Differs from Traditional Revenue Cycle Management (RCM)

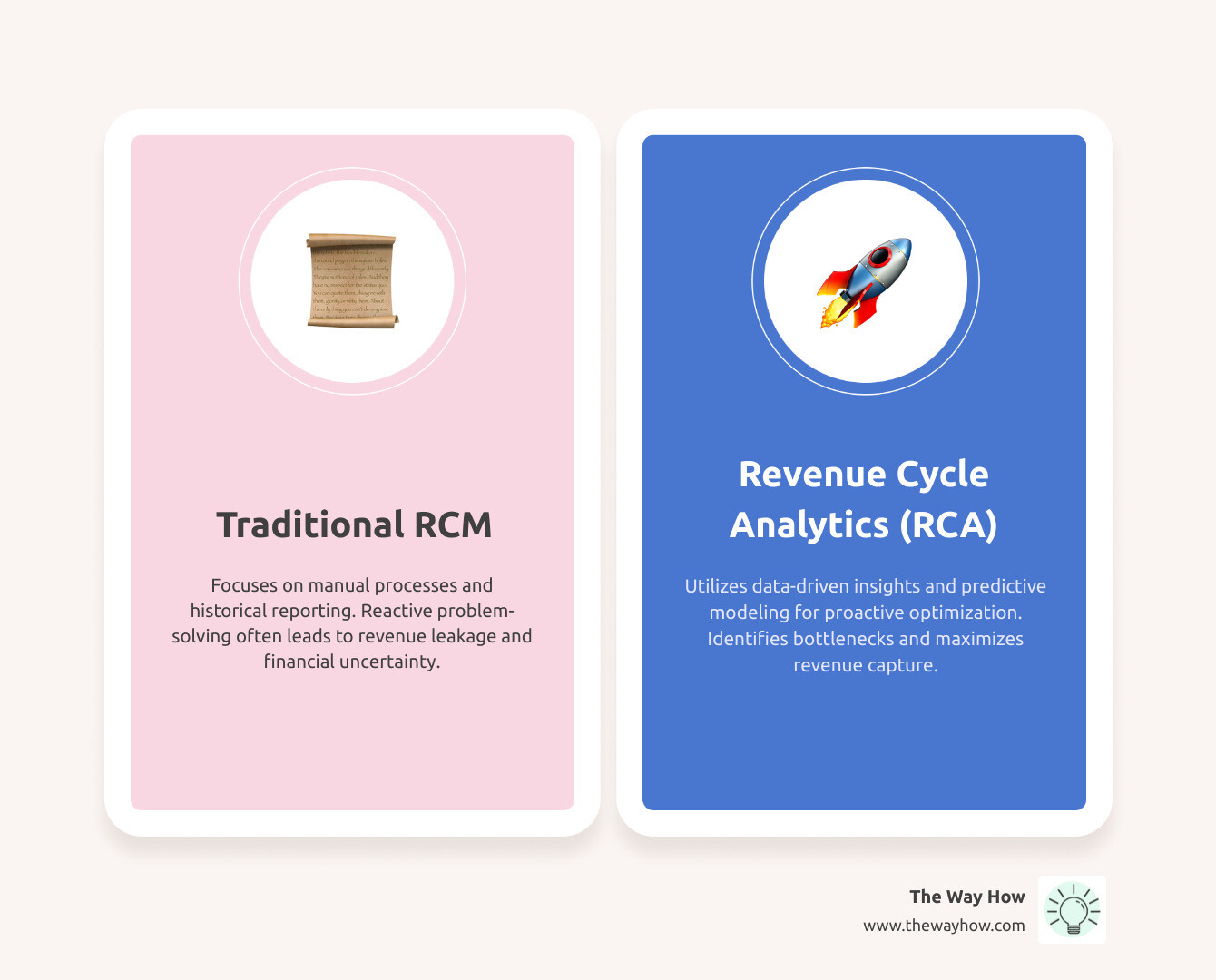

To truly grasp the power of RCA, understand how it lifts beyond traditional Revenue Cycle Management (RCM). Think of RCM as the engine that keeps the financial machine running – it’s the process, the sequence of steps from patient registration to payment posting. RCA, on the other hand, is the intelligent dashboard and navigation system that tells us how that engine is performing, where it's going, and what adjustments we need to make to reach our destination efficiently.

Traditional RCM often relies on manual processes, historical reporting, and reactive problem-solving. We might see a dip in cash flow and then investigate after the fact. It’s akin to driving by looking only in the rearview mirror. This approach, while necessary for basic operations, often leaves organizations guessing about the root causes of financial inefficiencies.

RCA fundamentally shifts this paradigm. It introduces proactive intelligence, predictive insights, and automated analysis. Instead of just reporting what happened, RCA helps us understand why it happened and what is likely to happen next. This allows us to make Data-Driven Decisions that prevent issues before they escalate. For instance, while RCM executes claims submission, RCA analyzes denial patterns to prevent future denials.

The distinction is critical, especially in complex environments like healthcare. The revenue cycle management market is projected to grow to $238 billion by 2030, and a notable 78% of health systems are indicating the adoption of RCM automation. This growth isn't just in automating existing processes; it's in leveraging analytics to make those automated processes smarter and more effective.

Here’s a quick comparison:

| Feature | Traditional RCM | Revenue Cycle Analytics (RCA) |

|---|---|---|

| Focus | Managing the flow of revenue activities | Optimizing financial performance through data insights |

| Approach | Reactive problem-solving, historical reporting | Proactive intelligence, predictive modeling |

| Data Usage | Transactional records, basic reports | Comprehensive data analysis, trend identification |

| Decision-making | Intuition, experience-based, after-the-fact | Data-driven, evidence-based, forward-looking |

| Goal | Process claims, collect payments | Maximize revenue, minimize leakage, improve efficiency |

Uncovering the "Why": Core Components and Insights of RCA

When we talk about what is revenue cycle analytics, we're not just discussing a single tool or a simple report. We're referring to a comprehensive system designed to bring unprecedented clarity to our financial operations. This system relies on several core components working in harmony, each contributing to a deeper understanding of our revenue stream. It's about taking fragmented data points and weaving them into a coherent narrative that reveals the "why" behind our financial performance.

The Four Tiers of Analytical Insight

To truly open up the power of RCA, we leverage different types of analytics, each providing a distinct tier of insight:

- Descriptive Analytics (What Happened): This is the foundational layer, answering the question, "What happened?" It involves summarizing past data, such as total claims submitted, denial rates, or average days in A/R. While essential, it’s like looking at a static picture of the past.

- Diagnostic Analytics (Why It Happened): Moving beyond simple descriptions, diagnostic analytics digs into the "Why?" It explores the root causes of past events. For instance, if denial rates increased, diagnostic analytics might pinpoint specific coding errors, payer policies, or patient eligibility issues as the culprits. This is where we start to understand the mechanisms of our revenue cycle.

- Predictive Analytics (What Will Happen): This is where RCA truly shines, addressing "What will happen?" By analyzing historical data and identifying patterns, predictive models forecast future outcomes. This could include predicting which claims are likely to be denied, which patients might struggle with payments, or what impact a new payer contract might have on our revenue. It allows us to anticipate challenges and opportunities.

- Prescriptive Analytics (What We Should Do): The most advanced tier, prescriptive analytics answers, "What should we do?" Based on predictive insights, it recommends specific actions to optimize outcomes. For example, if predictive analytics flags high-risk claims, prescriptive analytics might suggest specific pre-submission edits or documentation requirements. This transforms data into actionable strategies, guiding us toward the most effective interventions.

Together, these tiers form a powerful framework for Business Data Analysis, moving us from merely observing financial performance to actively shaping it.

Gaining Clarity Across the Revenue Cycle

An effective revenue cycle analytics program demands comprehensive data collection from multiple sources. It’s not enough to look at just one part of the journey; we need a holistic view across every stage of the revenue cycle. This includes:

- Patient Access & Registration: Analyzing data from patient demographics, insurance verification, and pre-authorization processes can identify issues leading to future denials or payment delays.

- Charge Capture & Coding Accuracy: RCA scrutinizes the accuracy and completeness of service documentation and coding. Identifying under-coding or incorrect coding practices ensures that all services rendered are billed appropriately.

- Claims Management & Submission: This component focuses on the efficiency and accuracy of claim creation and submission, tracking first-pass acceptance rates and identifying common errors.

- Payment Posting & Denial Management: A critical area where RCA shines, analyzing payment discrepancies, denial reasons, and appeal effectiveness to reduce lost revenue.

- Accounts Receivable (A/R) Follow-up: Examining the timeliness and effectiveness of follow-up processes with payers and patients to accelerate collections.

To achieve this comprehensive view, an effective RCA program integrates data from various systems, including practice management systems, electronic health records (EHRs), clearinghouses, and payer portals. Robust data integration capabilities are essential to normalize and consolidate this information, providing a unified, accurate view of the entire revenue cycle.

The Role of AI and Machine Learning in Modern RCA

The evolution of what is revenue cycle analytics is inextricably linked to advancements in technology, particularly Artificial Intelligence (AI) and Machine Learning (ML). These technologies are not just enhancing RCA; they are fundamentally changing it, moving us closer to truly predictable revenue.

AI and ML empower RCA with capabilities that were once unimaginable:

- Predictive Denial Models: AI algorithms can analyze vast datasets of historical claims, identifying intricate patterns and factors that lead to denials. This allows us to predict with remarkable accuracy which claims are at high risk of denial before they are even submitted, enabling proactive intervention.

- Process Automation: AI-driven automation can streamline repetitive tasks within the revenue cycle, such as insurance eligibility verification, claim status checks, and even initial stages of denial appeals. This frees up human staff to focus on more complex, high-value tasks.

- Natural Language Processing (NLP): NLP allows RCA systems to interpret unstructured data, such as payer notes, denial reasons, and patient communications. This extracts valuable insights that would be missed by traditional structured data analysis, helping us understand the nuances of payer behavior and patient sentiment.

- Trend Identification: AI can detect subtle shifts and emerging trends in payer behavior, regulatory changes, or patient payment patterns far more quickly and accurately than human analysis. This allows for rapid adaptation of strategies to maintain optimal revenue performance.

According to Forbes, healthcare providers are increasingly automating various aspects of their revenue cycles, with a notable 78% of health systems indicating the adoption of RCM automation. This automation, powered by AI and ML, is crucial for navigating the complexities of modern healthcare finance and ensuring that organizations can respond dynamically to an ever-changing landscape.

The Benefits of a Data-First Approach to Revenue

Adopting a data-first approach through what is revenue cycle analytics isn't just about efficiency; it's about building a foundation for financial sustainability and predictable growth. For any organization, particularly in the intricate world of healthcare, the benefits extend far beyond simply collecting payments. They touch every aspect of operational efficiency, strategic decision-making, and even patient satisfaction.

As we noted earlier, According to McKinsey & Company, healthcare providers that embrace digital solutions and analytics can achieve productivity improvements of 15 to 20%. This isn't a minor tweak; it's a significant boost that can redefine an organization's financial trajectory. When we remove the guesswork and inject clarity into our revenue cycles, we naturally see a ripple effect of positive outcomes.

How RCA Helps Identify and Reduce Revenue Leakage

One of the most compelling benefits of RCA is its unparalleled ability to identify and plug revenue leakage. Think of revenue leakage as the slow drip that erodes our financial strength – money that should have been collected but wasn't, often without us even realizing it. RCA serves as a powerful diagnostic tool, pinpointing these hidden losses:

- Denial Pattern Analysis: RCA carefully analyzes claim denials, not just individually but in aggregate. It identifies recurring denial codes, specific payers, common coding errors, or departments where denials are prevalent. By understanding these patterns, we can implement targeted interventions to reduce future denials, turning potential losses into collected revenue. Effective analytics implementation, for instance, can reduce denial rates by up to 40%.

- Underpayment Identification: Payers sometimes underpay claims, either intentionally or due to complex contract interpretations. RCA compares expected reimbursement rates (based on contracts) with actual payments received, flagging discrepancies that indicate underpayments. This allows us to pursue legitimate additional revenue that might otherwise be overlooked.

- Missed Charges: In busy clinical environments, services rendered can sometimes go uncharged. RCA can cross-reference patient encounters, documented procedures, and billed services to identify potential missed charges, ensuring all billable services are captured.

- Write-off Analysis: While some write-offs are unavoidable, RCA helps us understand the reasons behind them. By categorizing and analyzing write-offs, we can identify systemic issues that contribute to uncollectible debt and implement strategies to prevent them.

According to a JAMA Network Open study, healthcare organizations typically lose 3-5% of potential revenue through various leakage points. For a large hospital with $3 billion in net revenue and a 10% denial rate, effective analytics could potentially recapture over $100 million in previously at-risk revenue. This isn't just about recovering lost money; it's about optimizing the entire system to prevent those losses in the first place.

How RCA Specifically Benefits the Healthcare Industry

The healthcare industry, with its labyrinthine billing codes, complex payer contracts, and sensitive patient interactions, finds particularly profound advantages in RCA. Here's how RCA contributes to better decision-making and a healthier bottom line:

- Reduced Denial Rates: By leveraging predictive analytics, RCA flags high-risk claims based on historical patterns and current characteristics, allowing for intervention before submission. This proactive approach significantly reduces the volume of denials, saving time and resources on appeals.

- Accelerated Cash Flow: RCA streamlines processes and accelerates payment cycles. Organizations that adopt comprehensive analytics often see a 15-20% reduction in A/R days, meaning they get paid faster, which is crucial for operational liquidity.

- Improved Payer Negotiations: With data-backed insights from RCA, healthcare organizations can approach payer negotiations from a position of strength. We can demonstrate patterns of underpayment, identify unfavorable contract terms, and negotiate for more equitable reimbursement rates.

- Improved Patient Financial Experience: What is revenue cycle analytics if not a tool to improve the patient journey? By understanding patient payment behaviors and identifying potential financial difficulties early, RCA can facilitate more empathetic and effective financial conversations, offering payment plans or financial assistance options. This reduces patient frustration and improves satisfaction.

- Compliance Monitoring: RCA continuously monitors billing and coding practices, cross-referencing them with the latest regulatory guidelines. This proactive compliance helps mitigate risks, avoid penalties, and ensure ethical billing practices.

The administrative burden in healthcare is staggering, and fragmented systems often lead to inconsistent data. RCA helps turn the lights on, providing clarity and confidence for healthcare CFOs. It provides the necessary Revenue Cycle Management Analytics to steer this complexity.

What Is Revenue Cycle Analytics If Not a System of Measurement?

At its heart, what is revenue cycle analytics is a sophisticated system of measurement. Just as a car's dashboard provides critical information about speed, fuel, and engine health, RCA offers a comprehensive view of our financial engine. It transforms raw data into understandable, actionable insights, allowing us to gauge performance, identify areas for improvement, and steer towards predictable financial outcomes.

Without clear, consistent metrics, we're left relying on intuition or fragmented information, which can lead to uncertainty and stalled growth. RCA provides the clarity needed for effective performance benchmarking and strategic goal setting, ensuring we're always moving in the right direction.

Essential Metrics (KPIs) to Track

To effectively measure and manage our revenue cycle, we need to focus on a set of Key Performance Indicators (KPIs) that provide a clear picture of financial health and operational efficiency. These aren't just numbers; they are diagnostic signals.

- Denial Rate: This measures the percentage of claims that are rejected or denied by payers. Top-performing healthcare organizations strive to maintain denial rates below 5%, while the industry average often hovers between 6% and 10%. A high denial rate signals issues in coding, documentation, or claims submission.

- Clean Claims Rate (First-Pass Yield): This KPI represents the percentage of claims paid correctly upon initial submission, without requiring any rework or appeals. Top-performing organizations achieve first-pass yields of 93% or higher. A high clean claims rate indicates efficient and accurate front-end processes.

- Days in Accounts Receivable (A/R): This measures the average number of days it takes to collect payment after a service has been rendered. It directly impacts cash flow and financial stability. The Healthcare Financial Management Association (HFMA) suggests that best-practice organizations maintain A/R days below 45, with top performers achieving 30-35 days.

- Net Collection Rate: This calculates the percentage of collectible revenue that is actually collected, after accounting for contractual adjustments and write-offs. It's a key indicator of overall collection effectiveness.

- Cost to Collect: This metric measures the cost incurred to collect a dollar of revenue. By tracking this, we can identify inefficiencies in our collection processes and optimize resource allocation.

By consistently monitoring these KPIs, we gain a panoramic view of our revenue cycle's performance, enabling us to quickly identify performance gaps and drive continuous financial improvement.

Implementing RCA: A Blueprint for Clarity and Control

Implementing what is revenue cycle analytics isn't a one-time project; it's a strategic shift towards a data-driven culture. It’s about creating a blueprint that replaces uncertainty with clarity and gives us greater control over our financial destiny. While the prospect might seem daunting, especially given the complexities of integrating various systems, a structured approach can pave the way for success.

How to Effectively Implement RCA

A successful RCA implementation hinges on meticulous planning and execution. Here are our recommended best practices:

- Assess & Define Objectives: Before diving into data, we must clearly define what we aim to achieve. Are we looking to reduce denial rates by a specific percentage? Improve A/R days? Improve patient satisfaction? Clear, quantifiable goals are three times more likely to achieve significant improvements than those with vague objectives. This initial assessment helps us understand the key pain points in our current revenue cycle.

- Ensure Data Quality & Integration: Data is the lifeblood of RCA. We need to consolidate financial data from multiple systems (EHRs, billing systems, CRM) into a unified, accurate view. Strong data integration and data quality are critical factors for analytics success. The American Academy of Family Physicians (AAFP) recommends implementing robust data governance to ensure accuracy. This means routine audits, standardized definitions, and clear accountability for data integrity.

- Select the Right Technology: Investing in the right revenue cycle analytics software is paramount. This technology should align with our organizational needs, offering capabilities like AI, automation, predictive analytics, and real-time reporting. Consider integration capabilities, scalability, and user experience.

- Foster Cross-Functional Collaboration: RCA impacts multiple departments – finance, operations, IT, and even clinical teams. Effective implementation requires buy-in and collaboration across these functions. Breaking down departmental silos ensures a holistic understanding of the revenue cycle.

- Train Your Team for an Analytical Mindset: Technology is only as good as the people using it. Equip our team with comprehensive training on both the technology and the analytical mindset needed to extract value from the insights. This empowers them to interpret data, ask critical questions, and contribute to data-driven decision-making.

Common Challenges Faced During Implementation

While the benefits of RCA are clear, the path to implementation isn't always smooth. We've observed several common challenges that organizations encounter:

- Data Silos: Information often resides in disparate systems that don't communicate effectively. Integrating these systems and normalizing data can be technically complex and time-consuming.

- Resistance to Change: Shifting from traditional, manual processes to a data-driven approach can meet with resistance from staff accustomed to old ways. This is a human behavior challenge as much as a technical one. Overcoming this requires clear communication, demonstrating the value of RCA, and involving staff in the process.

- Technical Complexity: Implementing advanced analytics solutions can require specialized IT expertise for setup, maintenance, and integration, which may not always be readily available internally.

- Lack of Skilled Resources: Interpreting complex analytical outputs and translating them into actionable strategies requires a specific skill set. Organizations may struggle to find or train staff with the necessary analytical capabilities.

Despite the clear benefits, adoption of advanced revenue cycle analytics remains inconsistent. A survey by the Healthcare Financial Management Association (HFMA) found that while 90% of healthcare financial executives recognize the importance of analytics, only about 40% report having mature analytics capabilities. This gap highlights the need for strategic planning and change management to truly harness the power of RCA.

What is revenue cycle analytics implementation for sales and marketing?

When we consider what is revenue cycle analytics from a psychology-first marketing and revenue strategy perspective, it's not just about healthcare claims. It’s about understanding the entire customer journey and identifying "certainty gaps" that can stall revenue, regardless of industry. For our sales and marketing stack, RCA helps us move beyond assumptions to data-backed strategies.

Here are the practical steps or questions we should consider:

- What are the key pain points in our current revenue cycle? This isn't just about delayed payments; it's about understanding why customers abandon carts, why leads don't convert, or why clients don't renew. RCA helps us diagnose these behavioral and systemic issues.

- Which metrics are most critical for measuring our financial performance? Beyond vanity metrics, RCA helps us identify KPIs that directly correlate to profitable customer behavior and predictable revenue.

- How can we integrate RCA with our existing CRM and financial systems? Seamless integration provides a holistic view of the customer journey, from initial engagement to final payment, revealing where psychological friction points exist.

- What training and resources do we need to effectively use RCA insights? Our teams need to be equipped not just with data, but with the understanding of human behavior to interpret that data and craft compelling strategies.

- How can we use RCA to improve our customer experience and satisfaction? By analyzing payment patterns, communication preferences, and feedback, RCA helps us design systems that create trust, reduce friction, and build long-term customer loyalty.

Turning Insight into a Predictable Growth Engine

The journey of understanding what is revenue cycle analytics is a journey toward clarity, control, and ultimately, predictable revenue. As we look to the future, RCA is ready for even greater evolution, driven by continuous innovation in technology and a growing demand for data-driven precision.

The future of RCA involves:

- Advanced AI/ML for Predictive and Prescriptive Analytics: Expect even more sophisticated algorithms that can forecast with higher accuracy and recommend increasingly nuanced, automated actions.

- Real-time Analytics: The ability to process and analyze data instantaneously will allow for immediate interventions and dynamic adjustments to revenue cycle processes.

- Advanced Visualization Tools: Intuitive dashboards and visual representations of complex data will make insights accessible to a broader range of stakeholders, fostering better collaboration.

- Deeper Integration with Business Intelligence (BI) Systems: RCA will become an even more integral part of overall organizational BI, providing a holistic view that connects financial performance with operational and strategic objectives.

For us at The Way How, this evolution is exciting because it aligns perfectly with our mission: helping founders and leadership teams remove uncertainty in their sales and marketing systems. RCA, particularly when approached with a psychology-first lens, is the ultimate tool for diagnosing why growth is stalled, identifying certainty gaps in the customer journey, and designing systems that create trust, momentum, and predictable revenue. It allows us to teach before we persuade, diagnose before we prescribe, and ultimately, turn marketing into a dependable growth engine.

Ready to transform your financial operations from reactive to predictable? Find out how to build a predictable revenue system that leverages the power of analytics and human behavior.

Want to Learn Something Else?

A Practical Guide to Healthcare Revenue Cycle Analytics