10 min read

Ultimate Checklist for Revenue Cycle Analytics Optimization

Jeremy Wayne Howell

:

Jan 18, 2026 7:41:17 PM

Beyond the Balance Sheet: Why Your Revenue Cycle Feels Like Guesswork

Revenue cycle analytics is the use of data-driven methods to measure, predict, and optimize every stage of healthcare revenue generation--from patient registration to final payment. It turns raw financial and operational data into actionable insights that reduce claim denials, accelerate cash flow, and recover lost revenue.

Here's what you need to know:

- It's a proactive, data-driven approach to financial operations, moving from reactive problem-solving to predictive prevention.

- Key benefits include 15-20% productivity improvements, denial rate reductions up to 40%, and 15-20% faster A/R cycles.

- Essential metrics include denial rates (<5%), clean claims rates (>=95%), and days in A/R (<45 days).

- A positive return on investment is typical within 12-18 months.

If you're a healthcare financial leader, you know the numbers are getting harder to predict. Hospital profit margins shrink while claim denials and patient responsibility increase. The pressure is real, but the uncertainty makes it unbearable--not knowing which processes are failing or where revenue is quietly disappearing.

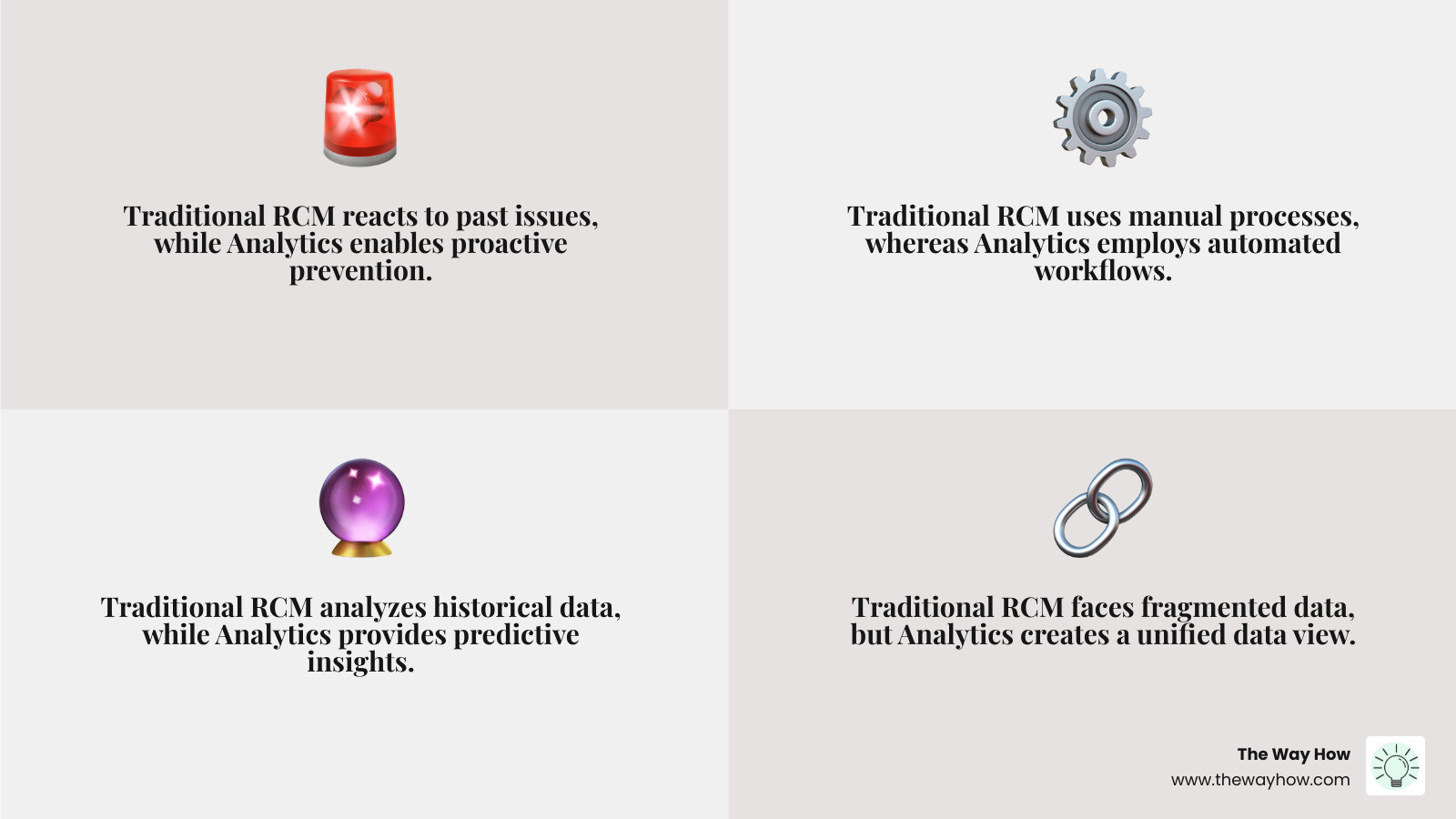

Traditional revenue cycle management operates in the rearview mirror, analyzing what already happened. It relies on manual processes, fragmented data, and gut instinct. Revenue cycle analytics is a different approach. Instead of asking "what went wrong?" it asks "what might go wrong?" It consolidates data into a unified view, identifies patterns invisible to human reviewers, and flags high-risk claims before submission.

The organizations seeing dramatic results--denial rates cut by 40%, A/R cycles shortened by weeks--are shifting from reactive firefighting to proactive system design. They are building certainty into a process that has always felt like guesswork.

Industry research shows that providers using digital solutions and analytics achieve productivity improvements of 15 to 20 percent. Yet a Healthcare Financial Management Association survey found that while 90% of financial executives see the value of analytics, only 40% have mature capabilities. The gap between knowing and doing is where most organizations get stuck.

This isn't a technology problem; it's a clarity problem. Leaders don't need more data. They need a framework for turning data into decisions and decisions into reliable revenue.

I'm Jeremy Wayne Howell, founder of The Way How. I've spent over 20 years helping organizations diagnose why their revenue systems stall. Revenue cycle analytics, when implemented with a psychology-first lens, doesn't just optimize billing--it eliminates the uncertainty gaps that cause revenue to leak.

The current landscape demands this shift. Patient responsibility has increased 32 percent in the last four years, adding complexity. Meanwhile, 10 to 20 percent of revenue is spent remediating denied claims, with many denials occurring during patient access. These issues ultimately result in a 1-3 percent loss of net revenue. This isn't just about efficiency; it's about survival.

From Data Chaos to Financial Clarity: The Core Processes of Revenue Cycle Analytics

The journey from scattered information to actionable insight begins with turning data chaos into financial clarity. Many organizations grapple with data silos, where critical information is isolated in disparate systems like electronic health records (EHRs), practice management systems, and payer portals.

The core processes of revenue cycle analytics are designed to overcome these challenges:

- Data Collection: Systematically gathering all relevant financial and operational data from every point in the revenue cycle.

- Data Integration: Bringing diverse data into a centralized platform to break down silos and ensure consistency. The American Academy of Family Physicians (AAFP) recommends strong data integration and quality for success.

- Data Analysis: Using analytical techniques to identify patterns, trends, and anomalies to understand performance.

- Performance Tracking: Continuously monitoring key performance indicators (KPIs) against benchmarks for real-time visibility.

- Revenue Optimization: Implementing strategies based on insights to improve revenue capture, such as refining billing practices.

- Reporting and Visualization: Translating complex findings into easy-to-understand dashboards and reports for strategic decision-making.

This structured approach to Business Data Analysis provides the foundation for data-driven decisions, moving organizations from guesswork to a clear understanding of their financial health.

What is revenue cycle analytics and how does it differ from traditional RCM?

Traditional revenue cycle management (RCM) is largely reactive. It focuses on managing revenue after services are rendered, often relying on manual processes to fix problems like denied claims or overdue payments. It's a cycle of fixing issues after they've already caused financial loss.

Revenue cycle analytics is a proactive, data-driven approach. It uses advanced tools to anticipate problems, identify root causes, and implement preventive measures. Instead of just noting a high denial rate, analytics helps us understand why claims are denied and how to prevent it. This shift from reactive to proactive is powered by predictive modeling and real-time monitoring, enabling true Data-Driven Decisions.

How does revenue cycle analytics benefit healthcare organizations?

The benefits of robust revenue cycle analytics impact the bottom line, operational efficiency, and patient satisfaction.

Here's how it transforms organizations:

- Improved Revenue Capture: By identifying undercoding and billing inaccuracies, analytics helps organizations capture earned revenue and enforce payer contracts.

- Improved Claims Processing: Analytics identifies common errors before submission, allowing for corrections that lead to faster reimbursements and more "clean claims."

- Reduced Denial Rates: Analytics identifies denial patterns and their root causes, enabling proactive adjustments. Predictive tools can flag high-risk claims before submission. Industry studies show this can reduce denial rates by up to 40%.

- Increased Patient Collections: With patient responsibility up 32% in four years, optimizing collections is vital. Analytics helps tailor collection strategies based on payment behaviors.

- Streamlined Billing Operations: By uncovering bottlenecks, analytics enables workflow improvements and automation, reducing administrative burden.

- Compliance Monitoring: Continuous analysis of billing and coding practices helps mitigate risks and ensures adherence to regulations.

- Improved Financial Performance Analysis: Analytics empowers leaders to analyze financial data and patient payment trends, pinpointing areas for revenue growth and cost reduction.

These benefits lead to substantial productivity gains. Industry research indicates that providers embracing analytics can achieve productivity improvements of 15 to 20%.

The Metrics That Matter: A Diagnostic Toolkit for Your Financial Health

In revenue cycle analytics, data is only as valuable as the insights it provides. To diagnose the health of your financial operations, we must focus on the right metrics. These Key Performance Indicators (KPIs) act as a diagnostic toolkit, offering clear signals about process health and areas needing attention.

Essential Key Performance Indicators (KPIs) for revenue cycle analytics

Tracking these specific KPIs allows for a rigorous, data-driven approach to optimizing your revenue cycle:

- Denial Rate: The percentage of claims denied by payers on first submission. Top-performing organizations maintain rates below 5%, while the industry average is 6-10%. A high rate signals upstream issues.

- Clean Claims Rate: The percentage of claims processed and paid without manual intervention. Organizations should aim for 95% or higher. A low rate indicates process inefficiencies.

- Days in Accounts Receivable (A/R): The average time it takes to collect payment. The Healthcare Financial Management Association (HFMA) suggests best-practice organizations maintain A/R days below 45.

- First-Pass Yield: The percentage of claims paid correctly on initial submission. Top performers achieve yields of 93% or higher. This metric is a powerful indicator of overall efficiency.

- Net Collection Rate: The percentage of collectible revenue actually collected, reflecting the effectiveness of collection efforts.

- Cost to Collect: The expense incurred to collect each dollar of revenue. A lower cost indicates greater efficiency.

| KPI | Poor Performance | Average Performance | Top Performance |

|---|---|---|---|

| Denial Rate | >10% | 6-10% | <5% |

| Clean Claims Rate | <90% | 90-95% | >=95% |

| Days in A/R | >60 days | 45-60 days | 30-35 days |

| First-Pass Yield | <85% | 85-93% | >=93% |

| Net Collection Rate | <90% | 90-95% | >95% |

How to identify and plug revenue leakage

Revenue leakage is the potential revenue that organizations fail to collect due to errors or missed opportunities. This can manifest as underpayments, write-offs, or uncollected balances. A JAMA Network Open study found that organizations typically lose 3-5% of potential revenue through leakage points.

Revenue cycle analytics is a powerful tool for identifying these leakage points. By analyzing patterns in claim denials, underpayments, and write-offs, we can pinpoint where revenue is being lost. For example:

- Analyzing Denial Reasons: A high number of denials for "lack of prior authorization" indicates a process breakdown in patient access.

- Payer Contract Management: Analytics can compare expected reimbursement against actual payments to identify underpayments and inform payer negotiations.

- Patient Payment Behavior: Understanding trends in patient self-pay helps optimize billing and collection strategies to improve recovery rates.

By identifying these patterns and their root causes, organizations can develop targeted interventions to plug these leaks. This proactive approach is at the heart of effective revenue cycle analytics.

Overcoming the Problems: Navigating the Human Side of Implementation

Implementing revenue cycle analytics isn't just about installing software; it's about navigating organizational and human challenges. The biggest problems often lie in data governance, change management, staff skills gaps, and technology selection. A Healthcare Financial Management Association (HFMA) survey found that while 90% of financial executives recognize the importance of analytics, only 40% report having mature capabilities. This gap highlights the prevalent challenges.

Common challenges faced when implementing revenue cycle analytics

We often find similar patterns of resistance and difficulty. These are common human and systemic obstacles:

- Data Silos and Territorialism: Data often resides in separate systems and also within departments that may be reluctant to share, hindering the integrated view needed for analytics.

- Poor Data Quality: Inaccurate or incomplete data can derail any analytics initiative. Without clear data governance, insights will be flawed.

- Resistance to Change: People are comfortable with existing workflows. New tools can be met with skepticism if staff don't understand the "why" or feel supported.

- Lack of Skilled Staff: Many organizations lack in-house talent with the analytical skills to interpret complex data and manage new platforms.

- Choosing the Right Technology: The market is flooded with solutions. Selecting the right software involves considering integration, scalability, user-friendliness, and vendor support.

Best practices for effective implementation

Overcoming these challenges requires a strategic approach that prioritizes clarity and human behavior:

- Set Clear, Quantifiable Goals: Define what success looks like before you start. Do you want to reduce denial rates by 10% or shorten A/R days by 5?

- Establish Strong Data Quality Programs: Implement robust data governance, routine audits, and clear accountability for data integrity. The American Academy of Family Physicians (AAFP) recommends this to ensure data accuracy.

- Involve Cross-Functional Teams: Engage stakeholders from all relevant departments early and often. This fosters buy-in and ensures the analytics address real-world needs.

- Provide Comprehensive Training: Empower your team with thorough training on how to use the tools and interpret the insights. Continuous support builds confidence.

- Start Small and Scale: Consider a phased implementation. A pilot program can demonstrate value and refine your approach before a full rollout.

- Focus on Business Analysis and Analytics: This is not just a technical exercise. It requires a deep understanding of business processes to translate data into meaningful actions.

By focusing on these practices, organizations can steer the human and systemic complexities of implementation.

The Future is Predictive: How AI is Eliminating Uncertainty in Revenue Management

The landscape of revenue cycle analytics is rapidly evolving, with artificial intelligence (AI) and machine learning (ML) at the forefront. These technologies are moving us beyond understanding what happened to predicting what will happen, eliminating many of the certainty gaps in traditional revenue management. The revenue cycle management market is projected to grow to $238B by 2030, a testament to the demand for these solutions.

How artificial intelligence (AI) is enhancing revenue cycle analytics

AI is a game-changer in healthcare finance, offering capabilities that human analysis alone cannot match.

Here's how AI is enhancing revenue cycle analytics:

- Predictive Capabilities: AI analyzes historical data to identify patterns that predict future outcomes, such as claim denials or payment delays. Predictive tools can reduce denial rates by up to 40% by flagging high-risk claims before submission.

- Automated Decision-Making: AI can automate routine tasks, like flagging claims for review or prioritizing accounts for follow-up, freeing up staff for more complex work.

- Pattern Recognition: Machine learning algorithms can identify subtle patterns in data that indicate the root cause of persistent issues, like a specific coding error or payer denial trend.

- Natural Language Processing (NLP): NLP allows AI to understand and extract insights from unstructured data like payer notes or denial explanations, helping to create more accurate appeals.

These advancements are central to modern Revenue Cycle Management Analytics, changing it from a reactive function to a strategic one.

The future outlook for revenue cycle analytics in healthcare

The trajectory for revenue cycle analytics points towards an increasingly automated, integrated, and patient-centric future.

- Increased Automation: We can expect greater adoption of automation across the revenue cycle. Forbes notes that 78% of health systems are already adopting RCM automation to streamline tasks and reduce errors.

- Greater Interoperability: The push for seamless data exchange between EHRs, billing systems, and payer networks will continue, creating a more unified data ecosystem for comprehensive analytics.

- Patient-Centric Financial Experiences: Analytics will help create more transparent and user-friendly financial experiences, such as personalized payment plans, improving satisfaction and collection rates.

- Value-Based Care Models: As healthcare shifts to value-based care, analytics will be indispensable for demonstrating outcomes, managing risk, and ensuring appropriate reimbursement.

This evolving landscape means organizations that accept advanced analytics will not only optimize their finances but also improve their resilience in a dynamic environment.

Frequently Asked Questions About Revenue Cycle Analytics

We frequently encounter similar questions from healthcare leaders seeking to understand and leverage the power of revenue cycle analytics.

What are the tangible financial benefits of implementing revenue cycle analytics?

The financial impact is often significant and provides a clear return on investment. Here are some tangible benefits:

- Significant ROI: Most providers see a positive return on investment within 12-18 months.

- Denial Rate Reduction: Effective implementation can reduce denial rates by up to 40%. For a mid-sized hospital, this could represent millions in recovered revenue.

- Reduction in A/R Days: Organizations often see a 15-20% reduction in Days in Accounts Receivable (A/R), which accelerates cash flow.

- Recapturing Lost Revenue: Analytics helps identify and prevent revenue leakage, allowing organizations to recover the 3-5% of potential revenue typically lost.

- Productivity Improvements: Analytics leads to productivity improvements of 15-20% by streamlining processes and reducing manual effort.

These benefits contribute to a stronger financial foundation for healthcare organizations.

Can small healthcare practices benefit from revenue cycle analytics?

Absolutely. While large systems implement comprehensive platforms, small practices can benefit significantly, sometimes even more proportionally. Smaller practices often have greater opportunities for improvement due to less sophisticated existing processes.

Cloud-based solutions now offer powerful analytical capabilities at a lower cost and with faster implementation. These tools can help small practices:

- Identify common billing errors.

- Reduce claim denials.

- Improve patient collections.

- Gain insights into financial performance without extensive IT infrastructure.

For any practice, understanding What is Revenue Cycle Analytics is the first step. The ability to make data-driven decisions is a necessity for all providers seeking financial stability.

How do you choose the right revenue cycle analytics software or vendor?

Choosing the right partner is a critical decision. A thoughtful evaluation process is essential. We guide our clients by focusing on several key areas:

- Assess Your Needs and Goals: Clearly define your organization's pain points and objectives. Are you focused on reducing denials, improving collections, or accelerating cash flow?

- Evaluate Integration Capabilities: The solution must integrate seamlessly with your existing EHRs and practice management systems. Poor integration defeats the purpose of analytics.

- Check for Scalability: Can the software grow with your organization and handle increasing patient volumes or new service lines?

- Request User-Friendly Demos: Prioritize intuitive interfaces and customizable dashboards. Involve end-users in the demo process for their feedback.

- Verify Vendor Support and Training: What kind of support and training does the vendor offer? Ongoing support is vital for adoption and continuous improvement.

- Consider Analytics Depth: Does the solution offer descriptive, diagnostic, predictive, and prescriptive analytics across all stages of your revenue cycle?

- Understand the Total Cost of Ownership: Consider implementation costs, training expenses, and maintenance fees beyond the initial licensing.

- Review Client References: Speak to other healthcare organizations of similar size that use the vendor's solution to learn about their experience.

For a more comprehensive approach, explore our Revenue Management Analytics Complete Guide. This process helps ensure you select a partner that aligns with your strategic vision.

Building Your Engine for Predictable Revenue

The shift from reactive guesswork to proactive, data-driven strategy in revenue cycle management is not merely a technological upgrade; it's a fundamental change in how healthcare organizations approach their financial future. We've seen how revenue cycle analytics transforms raw data into a powerful engine for predictable revenue, reducing uncertainty and building resilience.

At The Way How, we understand that true optimization goes beyond the numbers. It's about diagnosing the certainty gaps in your customer journey and building systems rooted in human behavior, empathy, and decision-making psychology. We believe that when you truly understand why growth is stalled, you can design systems that create trust, momentum, and dependable revenue.

By adopting revenue cycle analytics and approaching its implementation with strategic clarity, you're not just improving your billing process--you're building a more stable, predictable, and successful healthcare organization. To begin diagnosing the certainty gaps in your revenue system, explore our strategic services.

Want to Learn Something Else?

A Practical Guide to Healthcare Revenue Cycle Analytics