10 min read

From Growth to Pricing: A Deep Dive into Revenue Management Analytics

Jeremy Wayne Howell

:

Jan 15, 2026 7:41:34 PM

Why Most Revenue Strategies Fail Before They Start

Revenue management and analytics is the practice of using data to predict customer behavior and optimize pricing, inventory, and sales strategies to maximize revenue—but most businesses approach it backward, focusing on the numbers instead of the human decisions that create them.

Quick Answer: What You Need to Know

- What it is: A strategic system that combines behavioral data, demand forecasting, and pricing optimization to sell the right product to the right customer at the right time for the right price

- Why it matters: Businesses with fluctuating demand or diverse customer segments leave money on the table without it—often 3-10% of potential revenue

- Core components: Data collection, customer segmentation, demand forecasting, pricing strategy, and continuous measurement

- Common failure point: Treating it as a pricing tactic instead of a customer psychology problem

Here's the uncomfortable truth: most revenue leaders are flying blind.

You've invested in CRM systems, hired consultants, tested pricing strategies, and pored over dashboards. But you're still not sure why some customers convert and others don't. Why revenue spikes one quarter and flatlines the next. Why your sales team struggles to close deals at the prices you've set.

The problem isn't a lack of data. It's a lack of diagnosis.

Revenue management isn't about squeezing more margin out of transactions or matching competitor prices. It's about understanding the psychological drivers behind customer decisions—what they value, when they're ready to buy, and what price signals fairness versus exploitation.

The global revenue management market is growing at 9.6% annually because businesses are waking up to a reality: guesswork doesn't scale. The companies that win are the ones who build systems that replace intuition with insight, and tactics with strategy.

This guide will show you how to build that system. Not with buzzwords or software demos, but with a clear framework grounded in human behavior and backed by data. You'll learn what revenue management actually is (beyond the airline and hotel examples), why analytics is the engine that powers it, and how to implement a strategy that creates predictable growth instead of hoping for the best.

Before we dive into solutions, we need to establish a shared understanding of what we're really solving for—and why traditional approaches keep failing.

What is Revenue Management? (And Why It's Really About Customer Psychology)

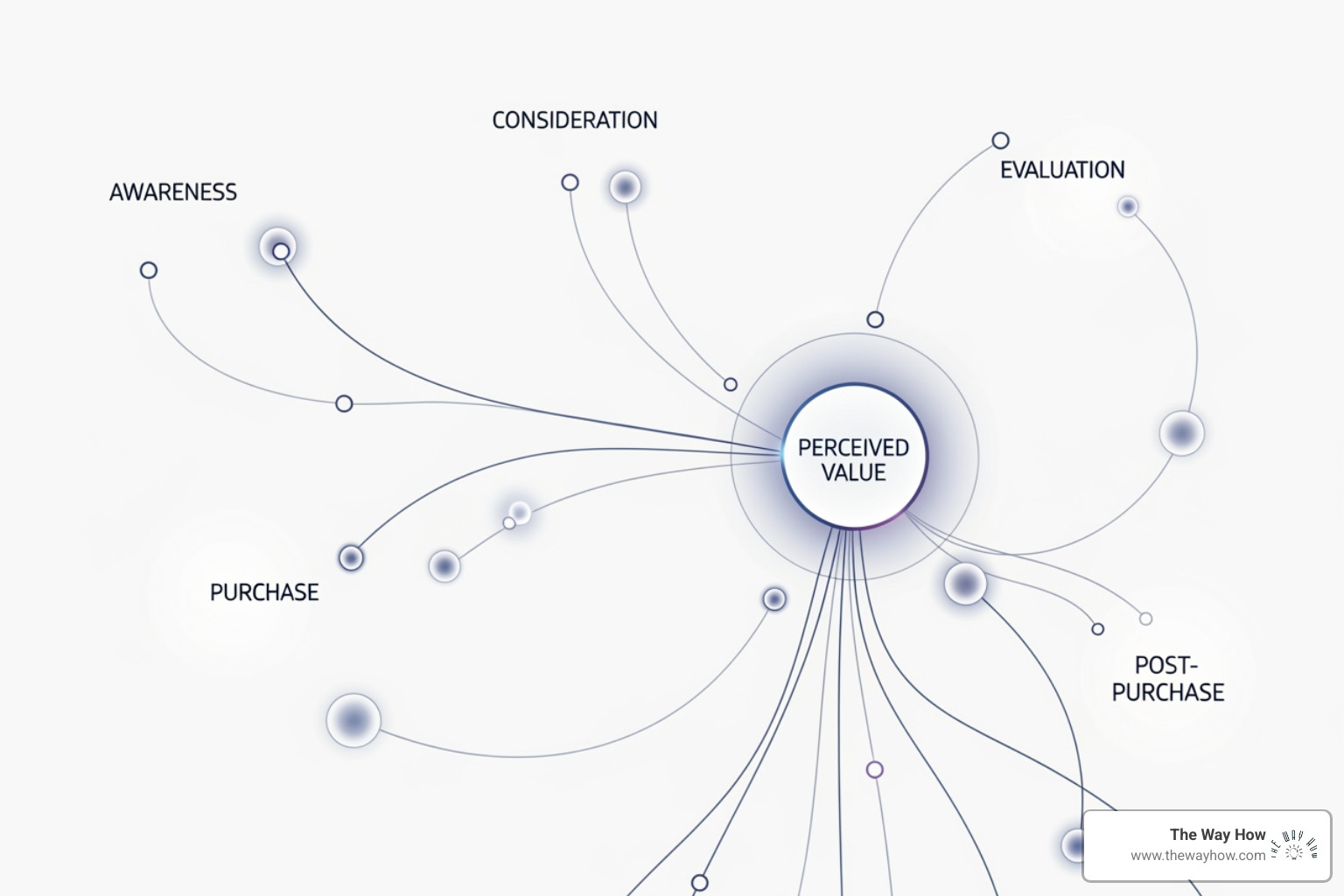

Revenue management and analytics is a strategic approach that uses data to anticipate customer behavior, allowing us to optimize pricing and product availability to maximize revenue. It’s about understanding the human decisions behind the numbers to sell the right product, to the right customer, at the right time, for the right price they perceive as fair. This is crucial for any business with fluctuating demand, perishable inventory, or diverse customer segments, as it provides the clarity needed to make profitable decisions instead of reacting to the market.

At its core, revenue management helps us get the most out of what we have to sell. It empowers management to make informed decisions by understanding demand, predicting favorable changes, allocating inventory by price and willingness to pay, anticipating supply constraints, and configuring products or processes for targeted customers. When done well, customer satisfaction actually improves because customers feel their needs are being noticed and met. It's about building trust by aligning our offerings with their perceived value.

Revenue Management vs. Yield Management: Strategy vs. Tactic

While often used interchangeably, there's a crucial distinction between revenue management and yield management. Think of it this way: one is the overarching strategy, and the other is a powerful tactic within that strategy.

| Feature | Revenue Management | Yield Management |

|---|---|---|

| Scope | Broader, strategic approach. Focuses on maximizing total revenue across all products/services, considering long-term customer relationships and value. | Narrower, tactical approach. Focuses on maximizing revenue from a fixed, depletable, and perishable inventory (e.g., airline seats, hotel rooms) by adjusting prices based on demand. |

| Time Horizon | Longer-term, allowing for more comprehensive planning and adapting to market shifts. | Shorter-term, focused on immediate sales and filling available capacity before it expires. |

| Goal | Optimizing pricing, product availability, and sales terms to maximize overall revenue and profitability. | Clearing inventory and maximizing revenue from that specific inventory. |

| Conditions | Applicable across most industries where demand fluctuates, and customer segments have different willingness to pay. | Requires specific conditions: fixed capacity, perishable inventory (e.g., a hotel room tonight that can't be sold tomorrow), and clear differences in customer willingness to pay. |

| Psychology Link | Deeply intertwined with understanding customer psychology, value perception, and building lasting relationships. | Often relies on more direct price sensitivity and urgency, though understanding segments' responses to price is still key. |

| Example | A SaaS company optimizing subscription tiers, feature bundles, and pricing models for different customer segments over several years to maximize customer lifetime value. | An airline adjusting ticket prices for a specific flight based on booking time, remaining seats, and expected demand to fill the plane before departure. |

Revenue management is the broader concept that allows for longer-term approaches to maximizing revenue and delivering value. Yield management is a type of revenue management that specifically focuses on clearing inventory by applying pricing and sales tactics to a fixed, depletable, and expiring inventory. Both rely on robust revenue management and analytics, but one is the chess match, the other is a specific move.

Why Traditional Pricing Models Fail

Many businesses still cling to outdated pricing models that simply don't account for the complexities of modern markets and, more importantly, modern psychology. Fixed pricing, cost-plus pricing, and competitor-based pricing often leave significant revenue on the table because they fundamentally misunderstand how customers make decisions.

Traditional methods often rely on manual calculations and basic historical data, making it challenging to respond effectively to real-time changes. Spreadsheets, while comfortable, are no longer efficient for managing revenue due to their time consumption and potential for human error. Many companies simply lack the necessary data collection and analytics processes to make accurate demand predictions, leading to a reactive rather than proactive stance.

The problem with a "numbers-only" approach is that it misses the "why." It assumes a linear rationality that often doesn't exist in human behavior. Businesses that fail to listen to customer changes—what they value, what they're willing to pay, and what experience they expect—are the ones that struggle. We're not just selling products; we're selling solutions to human problems, and our pricing must reflect that deep understanding.

The Core of Revenue Management and Analytics: From Data to Decisions

Data analytics is the engine of modern revenue management and analytics. It transforms raw data—what happened—into strategic insight—why it happened and what to do next. It’s the bridge from observing customer behavior to predicting it, allowing us to build a system for making smarter, faster, and more profitable decisions.

The ability to anticipate demand, backed by solid data collection, analysis, and modeling, empowers us to make important resource allocation and pricing decisions. Data analytics provides advanced tools to analyze vast amounts of information and extract valuable insights, revolutionizing how we approach revenue. It's crucial to understand the past and current performances of your company to diagnose growth stalls and identify certainty gaps.

Key Components of Revenue Management and Analytics

To effectively implement revenue management and analytics, several key components must work in harmony:

- Data Collection: Gathering comprehensive information, including historical sales data, customer behavior patterns, market trends, and competitor pricing.

- Segmentation: Dividing our market into distinct groups based on purchasing behavior, demographics, and preferences. This allows for custom pricing and offerings that resonate with specific customer psychologies.

- Demand Forecasting: Predicting future customer demand by analyzing historical data, seasonal trends, market dynamics, and external factors. This is where we anticipate when customers will want what.

- Price Optimization: Determining the optimal prices based on predicted demand, market conditions, and customer willingness to pay. Techniques include dynamic pricing, discounting, and bundling.

- Performance Measurement: Continuously tracking the effectiveness of our strategies through key performance indicators (KPIs) and making adjustments as needed.

Professionals with tactical skills in analytical tools for revenue analytics are in high demand, reflecting the growing understanding that these insights drive competitive advantage. We invite you to learn more about revenue analytics and its foundational principles.

How to Effectively Collect and Analyze Data

The success of your revenue management and analytics hinges on the quality and depth of your data. Think of it as building a strong foundation for your revenue house.

- Start with the "Why": Before collecting any data, ask yourself: What customer behavior are we trying to understand? What specific decisions do we need to inform? This prevents us from drowning in irrelevant data.

- Historical Sales Data: This is your bedrock. Document past orders, inventory levels, transaction details, and operational performance. This data reveals patterns and trends in what has worked (and what hasn't).

- Customer Behavior Patterns: Go beyond transactions. Analyze where, when, and how customers buy, their payment methods, purchase frequency, and even their browsing habits on your website. CRM data and website analytics are invaluable here. This helps us build customer profiles and buying personas.

- Market Trends: Keep an eye on the broader market. This includes seasonality, economic conditions, and industry-specific shifts. Integrate external data with your internal insights.

- Competitor Pricing: Regularly gather and analyze competitor data. While we don't advocate for simply matching prices, understanding competitor strategies helps us position our offerings effectively and identify opportunities.

- Data Quality is King: As the saying goes, "garbage in, garbage out." Inaccurate or incomplete data will lead to incorrect predictions and flawed strategies. Invest in reliable data collection methods and ensure data integrity.

By focusing our data collection efforts on these key areas, we can organize data into meaningful segments, identify patterns, and lay the groundwork for accurate forecasting and strategic decision-making.

Building Your Revenue Management Strategy: A Step-by-Step Framework

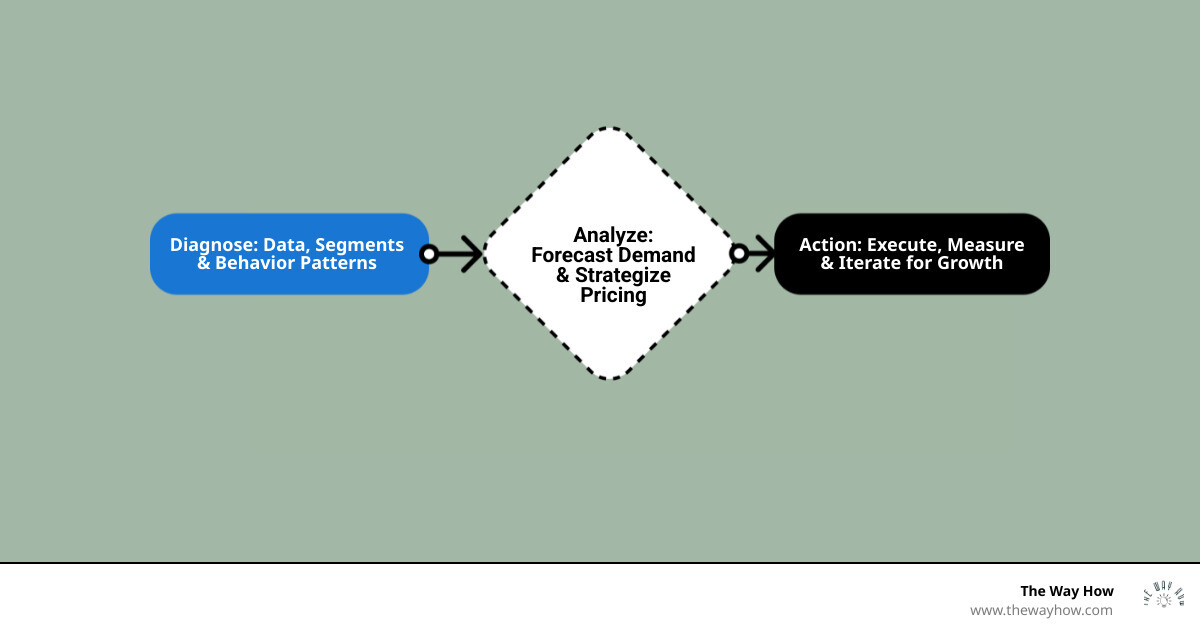

A successful strategy isn’t a one-time plan; it’s a continuous learning loop. It involves diagnosing your current state, forecasting future behavior, setting a clear strategy, executing it with your team, and measuring the results to refine your approach. This creates a resilient system that adapts to changing market dynamics. Revenue management is a continuously iterative process of gathering information, forecasting behavior, offering prices, evaluating results, and making adjustments. It's about building momentum through clarity and consistent improvement.

The 5 Steps to Executing a Revenue Management Strategy

Here’s our framework for developing and executing a robust revenue management and analytics strategy:

- Gather & Segment Data: This foundational step involves collecting all relevant information about your offerings, customers, calendar events, and market conditions. Then, segment this data into useful categories based on observable customer behaviors and market characteristics. For instance, you might segment customers by their willingness to pay, purchase frequency, or their response to promotions. This allows us to create detailed customer profiles or buying personas.

- Forecast Demand: Using your collected and segmented data, make accurate, data-backed predictions about future customer demand. This involves analyzing past trends, historical data, and economic conditions, and incorporating external factors that might influence demand. The goal is to anticipate when customers will want what, and how many. Human judgment still plays an important role alongside mathematical optimization in refining these forecasts.

- Set Pricing & Availability Rules: Based on your demand forecasts and customer segmentation, develop flexible pricing and availability strategies. This means using data insights to set optimal prices and manage inventory. Consider various pricing strategies like dynamic pricing (adjusting prices in real-time), bundle pricing, or even penetration pricing for new offerings. It's crucial to align these strategies with your risk levels and long-term business goals, not just short-term gains.

- Communicate & Execute: A brilliant strategy is useless if it's not effectively implemented. This step involves clearly communicating your pricing plan and overall revenue management and analytics strategy to your sales teams and other relevant departments. Ensure they understand the "why" behind the decisions and are equipped to handle customer questions and objections. Training and sales enablement are critical here to ensure everyone is aligned and executing consistently.

- Measure & Iterate: This is where the learning loop closes. Continuously review your results, analyzing key performance indicators (KPIs) and other metrics to determine what worked and what didn't. Use these learnings to refine and optimize your process. Experimentation, like A/B testing different pricing options, can provide valuable market information. Revenue management is not a static plan; it’s an ongoing dialogue with the market and your customers, constantly adapting and improving.

Key KPIs to Measure Success

Measuring the right metrics is essential for understanding the effectiveness of your revenue management and analytics efforts and identifying areas for improvement. Here are some key performance indicators (KPIs) that we focus on:

- Average Revenue Per Account (ARPA): This measures the average revenue generated from each customer account over a specific period. It helps us understand the value we're extracting from our customer relationships.

- Customer Lifetime Value (CLV): A projection of the total revenue a customer is expected to generate throughout their relationship with your business. This is crucial for long-term strategic planning and understanding the true value of customer acquisition and retention.

- Retention and Churn Rates: Your customer retention rate indicates the percentage of customers you keep over time, while the churn rate measures the percentage you lose. Given that it's typically more expensive to acquire new customers than to keep existing ones, these metrics are vital for sustainable growth. We can generate and track these by period, with customizable churn calculation methods.

- Forecast Accuracy: This KPI measures how close your actual revenue (or demand) came to your forecasted revenue. High forecast accuracy indicates a strong understanding of market dynamics and customer behavior, leading to more reliable decision-making.

- Revenue Per Available Room (RevPAR): While traditionally a hospitality metric, the concept can be adapted to other industries (e.g., revenue per available seat, per available hour of service). It measures the revenue generated per unit of available capacity, highlighting how effectively you're utilizing your resources.

These KPIs provide a clear picture of your company's profitability, customer loyalty, and overall financial health. For a more comprehensive understanding, you can get access to a comprehensive list of KPIs.

Overcoming Challenges and Looking to the Future

Implementing a robust revenue management and analytics system isn't without its problems. From ensuring data quality to fostering organizational alignment, there are common problems we encounter. However, by understanding these challenges and looking toward future trends, you can build a more resilient and forward-thinking revenue engine. It's about illuminating the path through the maze of uncertainty with clear, data-driven insights.

Common Implementation Challenges

Even with the best intentions, businesses often face significant obstacles when trying to implement or optimize their revenue management and analytics:

- Data Quality: This is perhaps the most fundamental challenge. As we mentioned, "garbage in, garbage out" applies directly to forecasting models. Inaccurate or incomplete data will lead to incorrect predictions and flawed strategies. Many companies simply lack the necessary data collection and analytics processes to make accurate demand predictions.

- Market Complexity: The market is constantly changing. Rapidly evolving conditions, unpredictable customer behavior, and aggressive competition make it difficult to forecast accurately and set optimal prices. This complexity requires constant vigilance and adaptability.

- Organizational Silos: Effective revenue management requires cross-functional collaboration. When sales, marketing, finance, and operations teams operate in silos, it creates communication breakdowns and prevents a unified strategy. A lack of shared understanding of the "why" behind pricing decisions can lead to internal friction and missed opportunities.

- Technology Investment: Implementing sophisticated revenue management and analytics often requires significant investment in technology and expertise. This can be a barrier for businesses, particularly smaller ones, though the ROI can be substantial (often 3-10% revenue uplift, with some reporting 10x average ROI).

- Overcoming Fear of Change: Humans are naturally resistant to change. Shifting from intuitive, experience-based pricing to a data-driven, analytical approach can be daunting for teams. There can be a fear of losing control, or a belief that "we've always done it this way." This is where strong leadership and clear communication about the benefits are crucial.

The Future of Revenue Management and Analytics: AI and Ethics

The future of revenue management and analytics is undeniably linked to advancements in Artificial Intelligence (AI) and Machine Learning (ML). These technologies are ready to revolutionize how we predict demand, optimize pricing, and interact with customers.

- AI-Powered Optimization: AI can process vast amounts of data—historical sales, market trends, competitive actions, even external factors like weather or news—at speeds and scales impossible for humans. This enables hyper-personalization and dynamic pricing that can adjust in real-time, optimizing every transaction. AI-powered pricing can lead to smarter, faster, and more profitable decisions, and can even be delivered as a service, combining software with expert support. Some platforms already generate over 250 million price recommendations daily for manufacturers, and power a significant percentage of industry ad sales.

- Predictive Forecasting: Machine learning algorithms are becoming incredibly adept at identifying subtle patterns and predicting future demand with higher accuracy, helping us anticipate market shifts and customer needs before they fully materialize.

- Ethical Considerations: As dynamic pricing and personalization become more sophisticated, ethical considerations become paramount. Practicing fairness and transparency with pricing strategies is crucial to avoid a loss of customer trust and loyalty. Customers need to feel that pricing is equitable and justified, not exploitative. The long-term impact of revenue management decisions on brand reputation and customer relationships must always be a guiding principle. Building customer trust through ethical AI implementation will be a key differentiator for successful businesses.

Conclusion: Build a System for Predictable Growth

Revenue management and analytics is more than a set of tools; it's a mindset shift. It’s about moving from reactive tactics to a proactive, psychology-driven system that creates clarity and confidence. By diagnosing the "why" behind your customer's behavior, you can build a dependable engine for growth that not only maximizes revenue but also builds lasting customer trust.

At The Way How, we believe this clarity is the foundation of any successful revenue strategy. We help founders and leadership teams remove uncertainty in their sales and marketing systems, diagnosing why growth is stalled and designing systems that create trust, momentum, and predictable revenue. Our work blends strategic clarity, behavioral insight, and operational execution to turn marketing into a dependable growth engine.

Ready to stop guessing and start growing? Explore how we can help you build a system for predictable revenue.

Want to Learn Something Else?

Ultimate Checklist for Revenue Cycle Analytics Optimization