10 min read

A Practical Guide to Healthcare Revenue Cycle Analytics

Jeremy Wayne Howell

:

Jan 17, 2026 7:41:04 PM

From Flying Blind to Financial Clarity

Healthcare revenue cycle analytics uses data-driven insights to optimize every stage of the revenue cycle, from patient registration to final payment. Unlike traditional revenue cycle management (RCM) that relies on manual processes and reactive fixes, an analytics-based approach provides proactive insights through predictive modeling, real-time monitoring, and automated reporting.

What healthcare revenue cycle analytics does:

- Identifies revenue leakage before it becomes a financial problem

- Predicts claim denials using historical patterns and AI-driven models

- Optimizes billing processes by uncovering bottlenecks and inefficiencies

- Improves cash flow by reducing days in accounts receivable (A/R)

- Provides real-time visibility into financial performance across the entire revenue cycle

Key benefits:

- Reduce denial rates by up to 40%

- Achieve 15-20% productivity improvements

- Lower A/R days to 30-45 days (vs. industry average of 50+)

- Recover 3-5% of revenue lost through leakage points

- Gain positive ROI within 12-18 months

Now more than ever, revenue cycle leaders need to pinpoint operational and financial challenges based on accurate data. By the end of 2023, 15 percent of initial claims were denied for payment, up from 9 percent in 2016. Administrative tasks such as prior authorizations now cost an average of $6 to $11 per claim for care delivery organizations. Meanwhile, patient responsibility for healthcare spend has increased 32 percent in the last four years, making every billing interaction a potential source of friction - or loyalty.

The problem isn't just the numbers. It's the uncertainty those numbers create.

When a healthcare leader asks for a report and receives three different answers from three different systems, they're not just dealing with a data problem. They're flying blind. They can't confidently present financials to the board. They can't predict cash flow. They can't identify which processes are bleeding revenue and which are performing well.

Healthcare revenue cycle analytics exists to turn the lights on.

It's not about adding more dashboards or hiring more analysts. It's about creating a single source of truth that connects patient access, billing, coding, claims management, and collections into one coherent system. It's about moving from "What happened last month?" to "What's likely to happen next month, and what can we do about it now?"

The shift from reactive management to proactive strategy isn't just a technical upgrade. It's a psychological shift - from uncertainty to confidence, from firefighting to forecasting, from hoping for better results to systematically engineering them.

This guide explains what healthcare revenue cycle analytics is, why it matters, and how to implement it effectively. We'll cover key processes, important metrics, common challenges, and best practices.

I'm Jeremy Wayne Howell, a revenue growth strategist with over 20 years of experience helping organizations remove uncertainty from their revenue systems. I've worked with healthcare providers and other complex businesses to implement healthcare revenue cycle analytics strategies that create predictable, sustainable growth by addressing the human and operational gaps underneath the numbers.

Healthcare revenue cycle analytics terms explained:

Beyond Reports: Shifting from RCM to Revenue Cycle Analytics

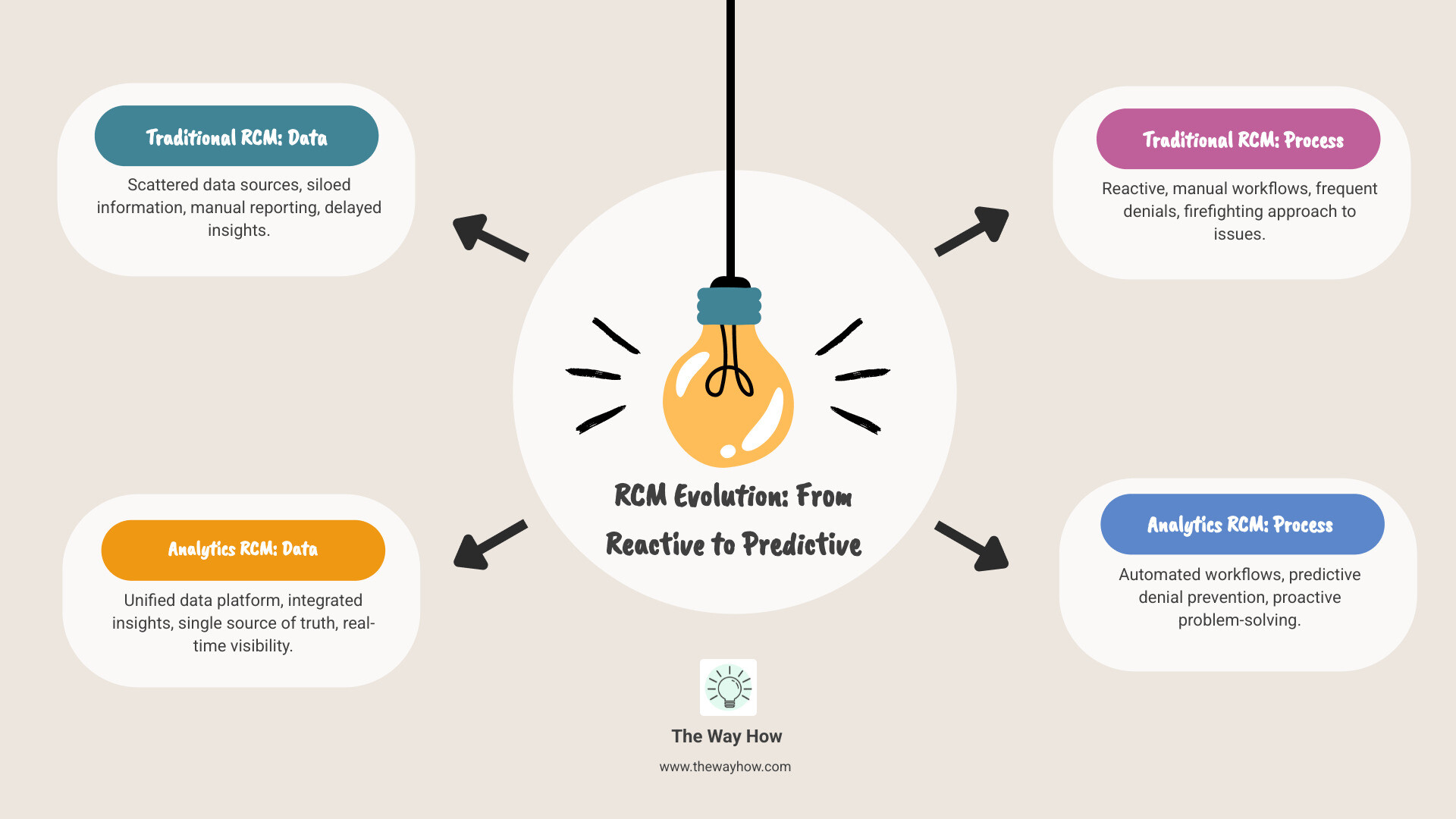

For too long, healthcare organizations have approached revenue cycle management with a reactive mindset, chasing problems after they've impacted the bottom line. Traditional RCM is like driving by looking in the rearview mirror; we see where we've been, but not where we're going. This approach leaves leaders feeling uncertain and unable to predict financial outcomes.

Healthcare revenue cycle analytics represents a fundamental shift. It's about moving from simply managing the revenue cycle to actively optimizing it through a data-driven approach. Instead of waiting for denials to pile up, we leverage advanced tools to identify patterns, predict future outcomes, and intervene proactively. This mindset shift removes the uncertainty that plagues traditional RCM, replacing it with clarity and foresight.

Let's consider the stark differences:

| Traditional RCM | Healthcare Revenue Cycle Analytics |

|---|---|

| Reactive problem-solving | Proactive insights and predictive modeling |

| Manual processes | Automated workflows and intelligent systems |

| Siloed data across disparate systems | Integrated data, creating a single source of truth |

| Retrospective reporting ("What happened?") | Predictive & prescriptive insights ("What will happen?" & "What should we do?") |

| Focus on individual transactions | Holistic view of the entire revenue cycle performance |

| Limited visibility into root causes of issues | Deep diagnostic capabilities for problem identification |

This isn't just an upgrade; it's a re-imagining of how we approach financial operations in healthcare. It's the difference between hoping for better results and systematically engineering them.

What is revenue cycle analytics and how does it differ from traditional RCM?

Traditional Revenue Cycle Management (RCM) is the process of tracking a patient encounter from registration to payment. While essential, its manual methods, retrospective reports, and data fragmentation often lead to inconsistent reporting, forcing leaders to "fly blind."

Healthcare revenue cycle analytics, in contrast, is a sophisticated business data analysis approach that analyzes financial and operational data to understand not just what happened, but why it happened and what will happen next.

The key difference is its proactive nature. Instead of reacting to problems, analytics provides proactive insights through predictive modeling and real-time monitoring. It creates a "single source of truth" by unifying data, which resolves the fragmentation and uncertainty common in financial reporting. This shift enables effective business analysis and analytics and gives CFOs greater confidence in their numbers.

The Core Processes That Create Certainty

Implementing healthcare revenue cycle analytics is a continuous cycle of improvement built on several core processes:

- Data Collection: Gather comprehensive data from all touchpoints, including practice management systems, electronic health records (EHRs), clearinghouses, and payer portals. Granular data leads to richer insights.

- Data Integration: Consolidate diverse data streams into a unified, accurate view to create a "single source of truth." This critical step involves normalizing data to ensure consistency and reliability for reporting.

- Data Analysis: Apply analytical techniques-descriptive, diagnostic, predictive, and prescriptive-to uncover trends, identify root causes, and forecast outcomes. This could include analyzing denial patterns or payment velocities.

- Performance Metrics Tracking: Define and monitor key performance indicators (KPIs) through dashboards and automated reports. This provides real-time visibility and allows for timely interventions when deviations occur.

- Revenue Optimization: Use insights to take action. This could involve improving billing accuracy, reducing denials, or tailoring patient payment strategies to maximize revenue capture and minimize leakage.

- Reporting and Visualization: Transform complex analyses into clear, actionable reports and visualizations. This makes it easier for leaders to interpret data, identify opportunities, and make informed decisions.

The Anatomy of a Data-Driven Revenue Engine

Moving from uncertainty to predictable revenue requires a clear understanding of what to measure. It's not enough to collect data; we need to diagnose what it's telling us about the health of our revenue cycle.

This is where the anatomy of a data-driven revenue engine comes into play, focusing on key performance indicators and the tangible benefits of a well-tuned analytics strategy.

Key Performance Indicators (KPIs) That Tell the Real Story

KPIs are the vital signs of your revenue cycle, providing objective measures of performance. Tracking them reveals what's happening, why, and what to do about it. The most critical metrics include:

- Denial Rate: The percentage of claims rejected by payers. Top-performing organizations maintain rates below 5%. Effective analytics can reduce denial rates by up to 40%. This is crucial, as remediating denials is costly, and many originate during patient access.

- Clean Claims Rate: The percentage of claims submitted without errors that are paid on the first submission. A high rate (targeting 95% or higher) is a hallmark of an efficient revenue cycle.

- Days in A/R (Accounts Receivable): The average time it takes to collect payment. The HFMA suggests best-practice organizations maintain A/R days below 45, with top performers at 30-35 days. Analytics can reduce A/R days by 15-20%.

- First-Pass Yield: The percentage of claims paid correctly upon initial submission. According to Inovalon, top performers achieve yields of 93% or higher. This metric represents the most efficient path to revenue.

- Collection Rate: The percentage of collectible revenue actually gathered from payers and patients. Analytics helps optimize collection strategies by identifying payment behaviors and improving engagement.

Tracking these KPIs helps identify performance gaps, pinpoint revenue leakage, and drive continuous financial improvement.

The Primary Benefits of Implementing Healthcare Revenue Cycle Analytics

The benefits of implementing healthcare revenue cycle analytics extend far beyond financial reporting, fundamentally changing how organizations operate.

- Improved Revenue Capture: Analytics helps capture every dollar earned by identifying under-coding, ensuring billing accuracy, and detecting underpayments. This mitigates the 3-5% of revenue typically lost to leakage.

- Improved Claims Processing: By identifying common errors before submission, analytics streamlines the claims process, leading to a higher clean claims rate and faster reimbursements.

- Reduced Denial Rates: Predictive tools flag high-risk claims, allowing intervention before submission. Effective analytics can reduce denial rates by up to 40%, potentially recovering millions in revenue for a mid-sized hospital.

- Increased Patient Payment Collections: Analyzing patient financial behaviors helps tailor engagement strategies and boost collections, which also improves patient satisfaction in an era of high patient responsibility.

- Streamlined Billing Operations: Analytics uncovers bottlenecks in the billing process, enabling workflow improvements and automation. This can lead to productivity improvements of 15 to 20%.

- Data-Driven Decision-Making: This is the core psychological shift. Leaders can make informed decisions based on clear, actionable insights, leading to more effective resource allocation and strategic planning. Explore more on Data-Driven Decisions.

- Compliance Monitoring: Analytics helps monitor billing and coding practices against the latest guidelines, mitigating risks and avoiding costly penalties.

- Improved Financial Performance Analysis: It provides a real-time view of financial health, enabling better forecasting, budgeting, and overall financial strategy, often reducing A/R days and improving cash flow.

Navigating the Headwinds: A Blueprint for Successful Implementation

The promise of healthcare revenue cycle analytics is clear, but the path to implementation isn't always smooth. Many leaders face common obstacles, often rooted in the uncertainty of integrating new technologies and changing workflows. Our role is to provide a clear, psychology-first roadmap to anticipate and overcome these challenges.

Common Challenges and How to Overcome Them

Despite clear benefits, adoption is inconsistent. While 90% of healthcare financial executives see the value in analytics, only about 40% report having mature capabilities. This gap points to several common problems:

- Data Integration Issues: Financial data is often siloed across multiple systems. Consolidating these sources into a unified "single source of truth" is a major technical challenge that requires robust integration capabilities.

- Staff Resistance to Change: Introducing new tools can be met with skepticism. A psychology-first approach is vital: communicate the "why," provide training, and show how analytics empowers staff, rather than replaces them.

- Software Complexity: Overly complex platforms deter adoption. The solution should be user-friendly, intuitive, and designed with the end-user in mind.

- Lack of Clear Objectives: Without defined goals (e.g., "reduce denial rate by X%"), implementation can flounder. Organizations with clear goals are three times more likely to see significant improvements.

- Ensuring Data Quality: "Garbage in, garbage out" is a harsh truth. Inaccurate or incomplete data leads to flawed insights. Prioritizing data governance is paramount.

Best Practices for an Effective Rollout

To steer these challenges and ensure a successful implementation, we recommend these best practices:

- Define Clear, Quantifiable Goals: Before selecting a system, articulate what you aim to improve, such as reducing A/R days or cutting denial rates. This provides direction and a benchmark for success.

- Prioritize Data Governance and Quality: Implement robust data governance, including routine audits and clear accountability for data maintenance. The AAFP recommends robust data governance to ensure accuracy.

- Foster a Data-Driven Culture: This is a psychological shift. Encourage curiosity, provide training, and demonstrate how analytics empowers staff to make better decisions. Celebrate successes to show tangible improvements.

- Invest in User-Friendly Tools: Choose analytics platforms with intuitive interfaces and customizable dashboards that don't require extensive technical expertise. Cloud-based solutions often offer faster implementation.

- Ensure Cross-Functional Collaboration: Involve stakeholders from patient access, clinical, coding, and finance in the planning process to ensure buy-in and address interdepartmental dependencies. This is key to optimizing Revenue Cycle Management Analytics.

- Start Small, Scale Smart: Don't try to solve every problem at once. Identify a high-impact area, demonstrate success, and then expand. This builds confidence and momentum.

- Provide Comprehensive Training: Equip your team with the skills to interpret analytics and leverage insights through targeted training on both the software and analytical thinking.

- Monitor, Evaluate, and Adapt: Analytics is an ongoing process. Regularly review outcomes against your goals and be prepared to adapt your strategies based on new insights.

The Future is Predictive: AI and the Next Frontier of RCM

The landscape of healthcare is constantly evolving, and so must our approach to revenue cycle management. The future of healthcare revenue cycle analytics is about predicting what will happen and prescribing the best course of action. This shift is being profoundly shaped by advancements in artificial intelligence (AI) and machine learning.

AI is not just a buzzword; it's a powerful tool that helps us remove uncertainty by analyzing vast amounts of data at speeds impossible for humans. It allows us to move from reactive problem-solving to proactive optimization on our What is Revenue Cycle Analytics journey.

How Artificial Intelligence (AI) is Enhancing Healthcare Revenue Cycle Analytics

AI significantly improves healthcare revenue cycle analytics by enabling advanced capabilities. It processes complex patterns, automates tasks, and allows for data-driven decisions with unprecedented accuracy.

- Predictive Capabilities: AI analyzes historical data to predict claim denials, payment delays, and collection issues before they happen. This allows for proactive intervention on high-risk claims or accounts.

- Automated Decision-Making: Machine learning can automate routine decisions like claim routing or coding suggestions, freeing up staff for complex tasks. This is a key reason why 78% of health systems are adopting RCM automation.

- Pattern Recognition: AI excels at identifying subtle patterns in data that might indicate fraud, coding errors, or process inefficiencies, such as trends in specific payer denials.

- Natural Language Processing (NLP): NLP allows AI to extract insights from unstructured data like clinical notes or denial reasons, automating root cause analysis faster and more accurately than manual review.

- Prescriptive Analytics: Building on predictions, AI can recommend specific actions to optimize revenue, such as the best follow-up strategies for outstanding balances.

The potential is substantial. Research suggests that generative AI could lead to savings of 5 to 10 percent in US healthcare spending, highlighting its transformative power.

Choosing the Right Analytics Partner

Implementing advanced analytics often means partnering with a technology vendor. The right partner can accelerate your journey, while the wrong one can create more uncertainty. When choosing a vendor, consider the following:

- Integration Capabilities: Can the solution seamlessly integrate with your existing EHR and billing systems? Look for robust APIs and a track record of successful integrations.

- Scalability: Can the solution grow with your organization and handle increasing data volumes and complexity?

- User Experience (UX): Is the software intuitive for your team? A clunky interface leads to low adoption. Prioritize clear dashboards and minimal training requirements.

- Analytical Power: Does the vendor offer the depth of analytics you need (descriptive, predictive, prescriptive)? Does it leverage AI effectively?

- Vendor Support and Expertise: What ongoing support and training do they offer? A good partner acts as an extension of your team.

- Cost and ROI: Consider the total cost of ownership and the potential for a positive return on investment, which most providers see within 12-18 months.

- Build vs. Buy: Building your own solution requires significant resources. Buying a specialized solution often offers faster implementation and a lower total cost of ownership.

The best choice aligns with your organization's needs, budget, and goals, helping you find trends with Revenue Cycle Analytics. Our Revenue Management Analytics Complete Guide offers deeper insights.

Frequently Asked Questions About Revenue Cycle Analytics

We often hear similar questions from healthcare leaders exploring healthcare revenue cycle analytics. Let's address some of the most common ones.

How much can we expect to save by implementing revenue cycle analytics?

The financial impact is significant. While results vary, organizations often see:

- Denial rate reductions up to 40%.

- A/R days reduced by 15-20%, improving cash flow.

- Productivity gains of 15-20%.

- Positive ROI within 12-18 months.

These savings come from preventing denials, streamlining operations, and optimizing collections.

Can small healthcare practices benefit from revenue cycle analytics?

Yes. While large systems use enterprise platforms, smaller practices can leverage affordable, scalable cloud-based solutions. They often see proportionally greater benefits by fixing common errors, optimizing scheduling, improving patient collections, and negotiating better payer contracts with data. The key is choosing a tool that fits the practice's specific needs and budget.

How long does it typically take to implement an analytics solution?

Implementation typically takes 6-12 months, depending on complexity. The process includes a planning phase (2-3 months), system integration (3-6 months), and training/rollout (1-3 months). Cloud-based solutions are often faster, with initial insights possible within 60-90 days, offering a quicker time-to-value.

Turning Data into Predictable Growth

The journey from reactive firefighting to proactive financial management is not about finding a magic bullet, but about building a system that creates certainty. For healthcare organizations, this means embracing healthcare revenue cycle analytics as a core strategic imperative. We understand that the underlying problem for many leaders isn't just a lack of data, but the uncertainty that data fragmentation and reactive processes create.

By shifting your perspective and leveraging analytics as a diagnostic tool, you can transform your revenue cycle from a source of stress into a predictable engine for growth. This involves not just technology, but a psychology-first strategy that removes uncertainty from your systems, creates trust in your numbers, and builds momentum toward your financial goals.

At The Way How, we specialize in helping founders and leadership teams remove uncertainty in their sales and marketing systems. We diagnose why growth is stalled, identify certainty gaps in the customer journey, and design systems that create trust, momentum, and predictable revenue. Our work blends strategic clarity, behavioral insight, and operational execution.

If you're ready to stop flying blind and start building a revenue cycle that consistently delivers, we're here to help you steer that change.

Learn how our strategic services can help you build a predictable revenue engine

Want to Learn Something Else?

From Denials to Dollars: Mastering Revenue Cycle Management Analytics